📊 Team Selection Criteria

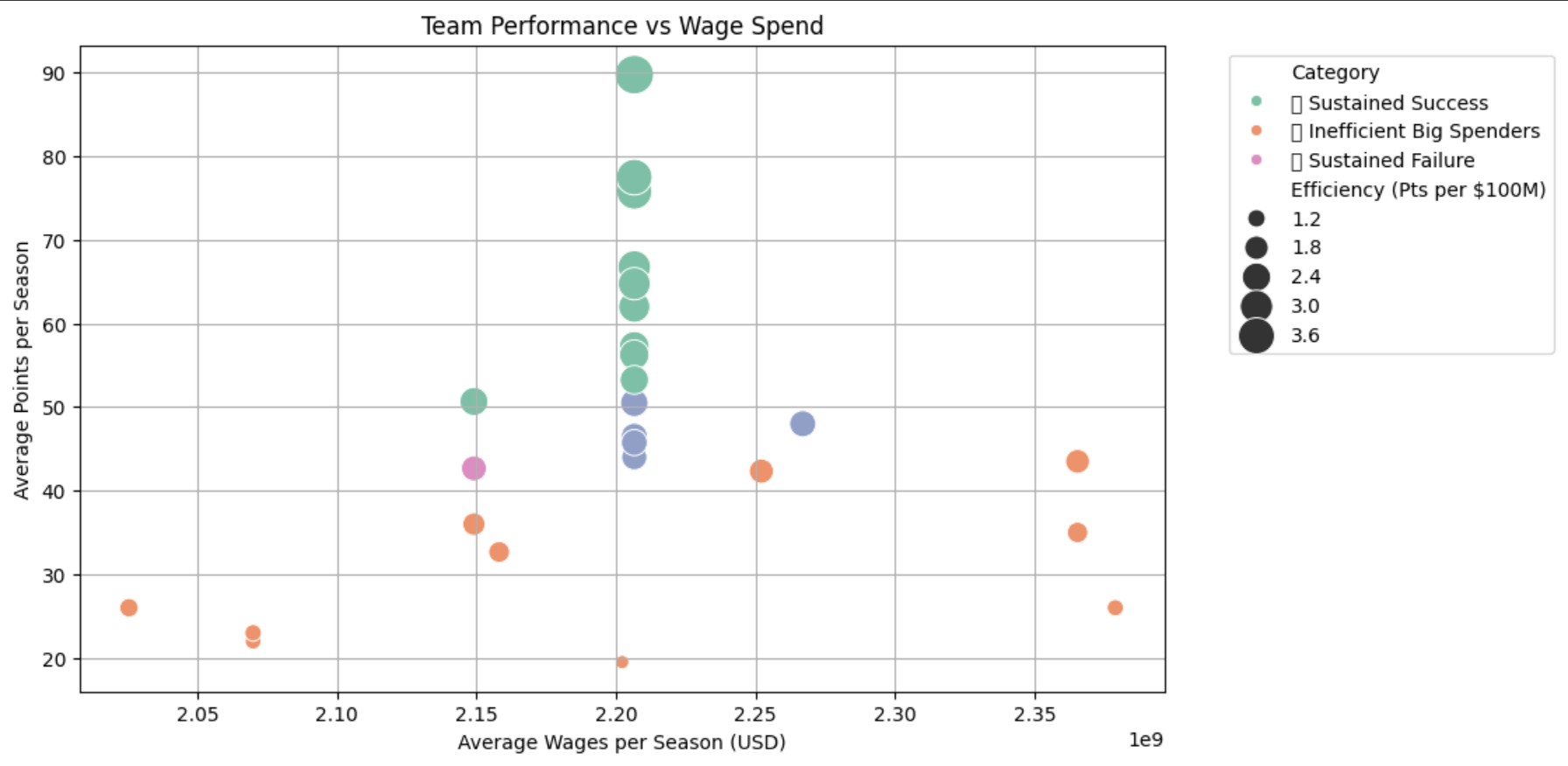

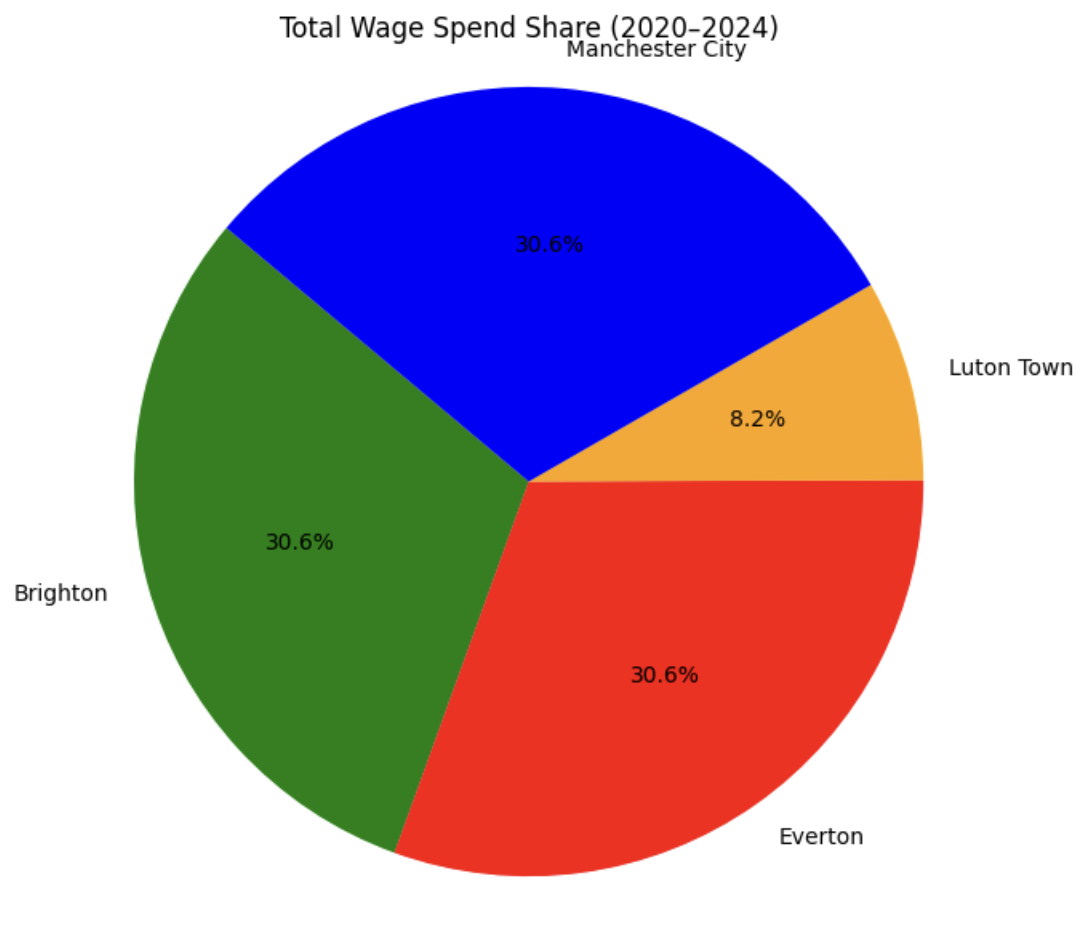

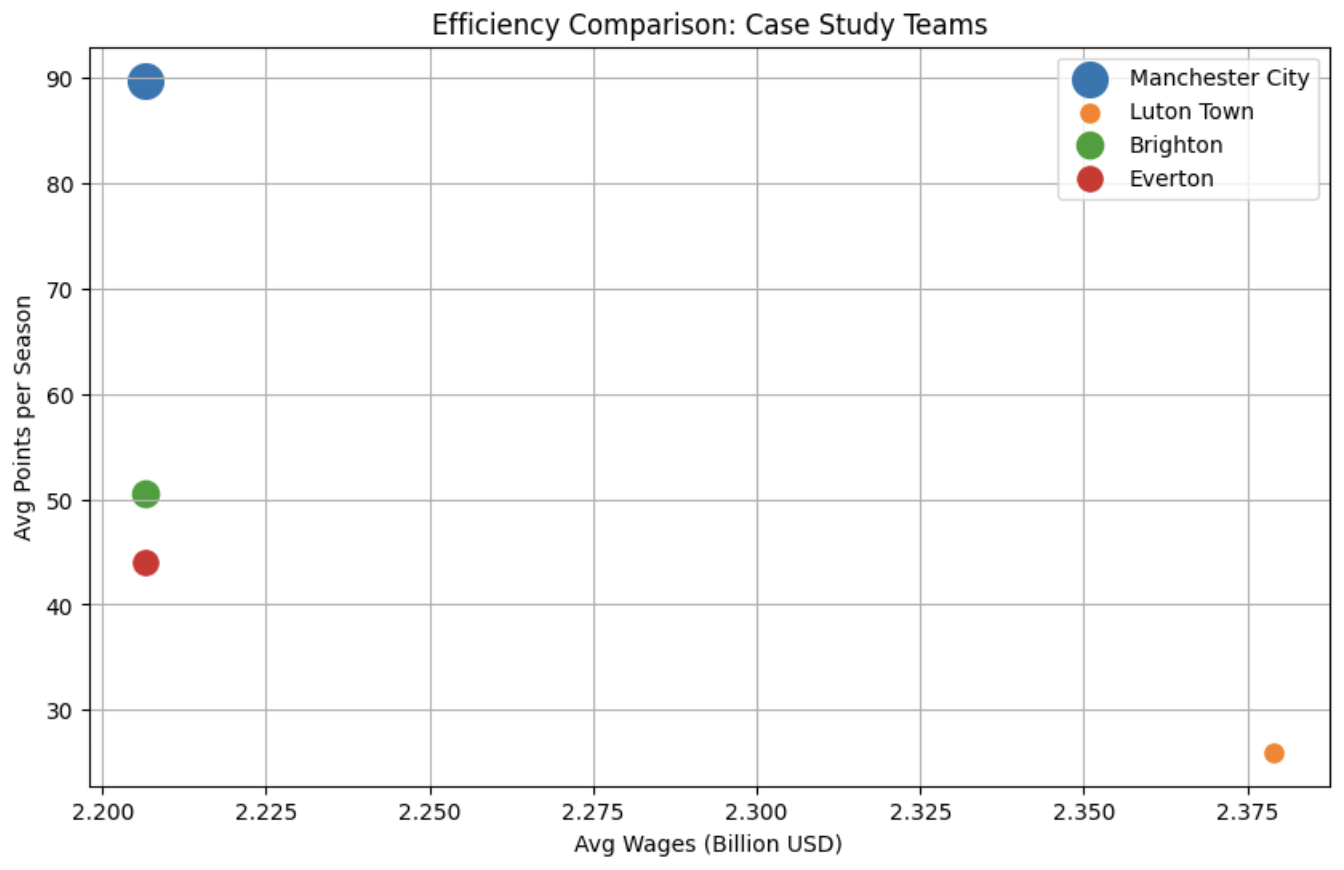

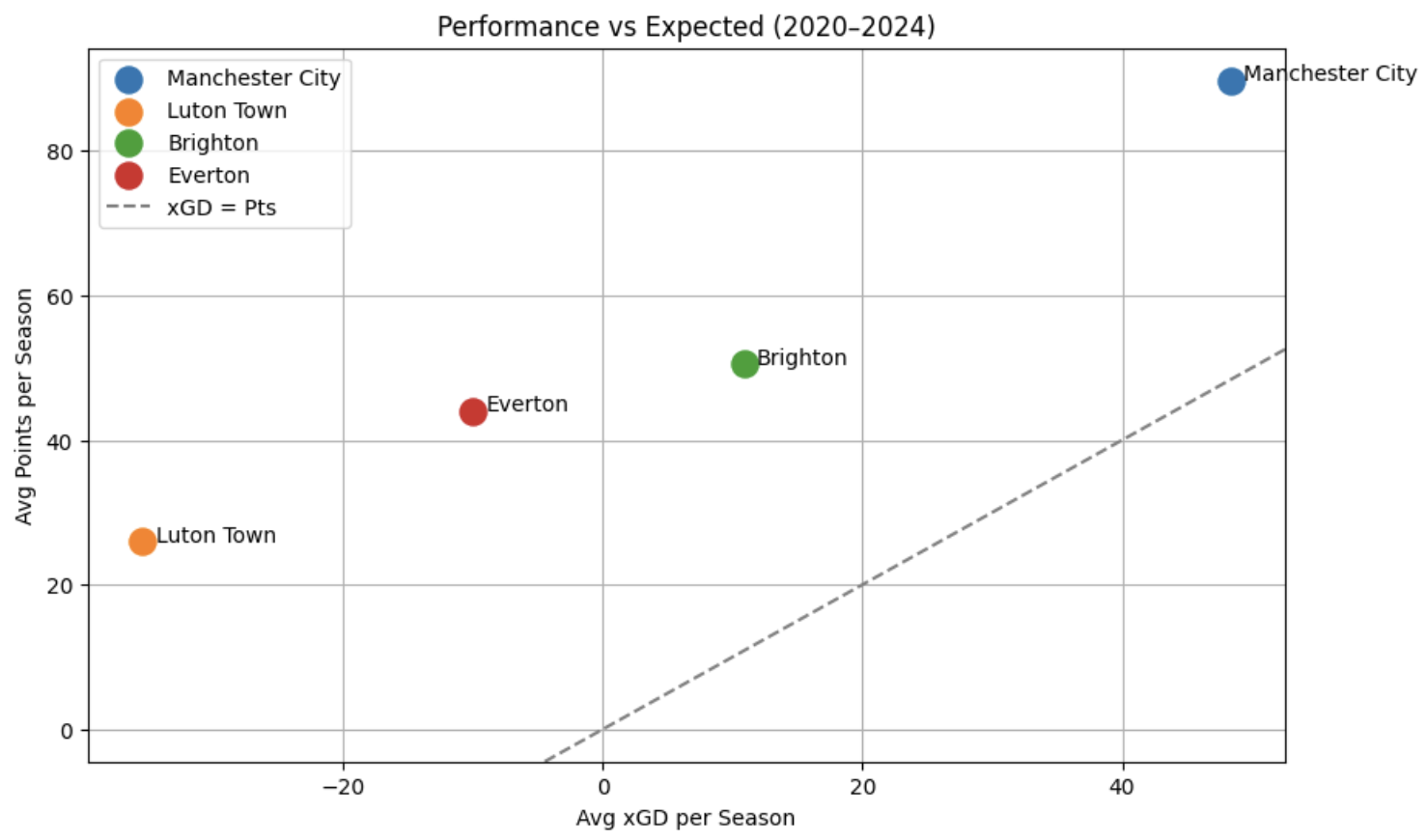

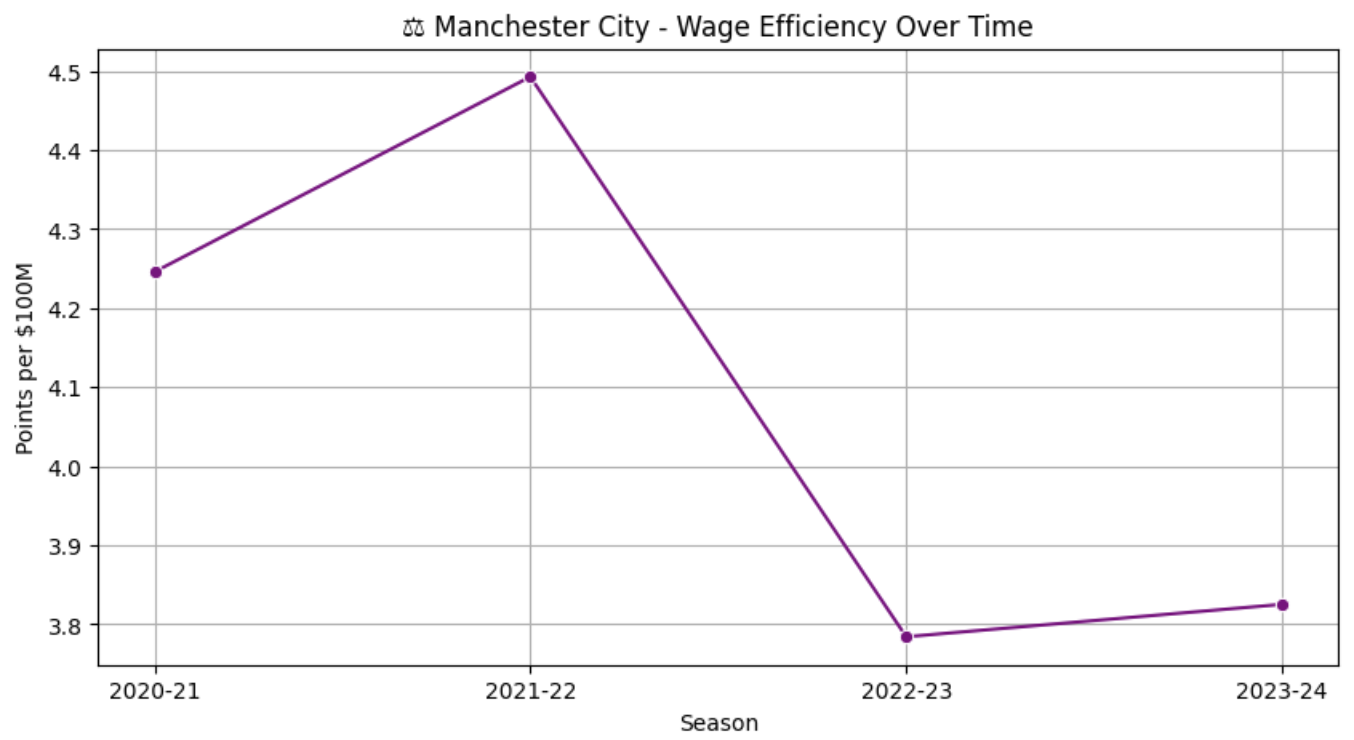

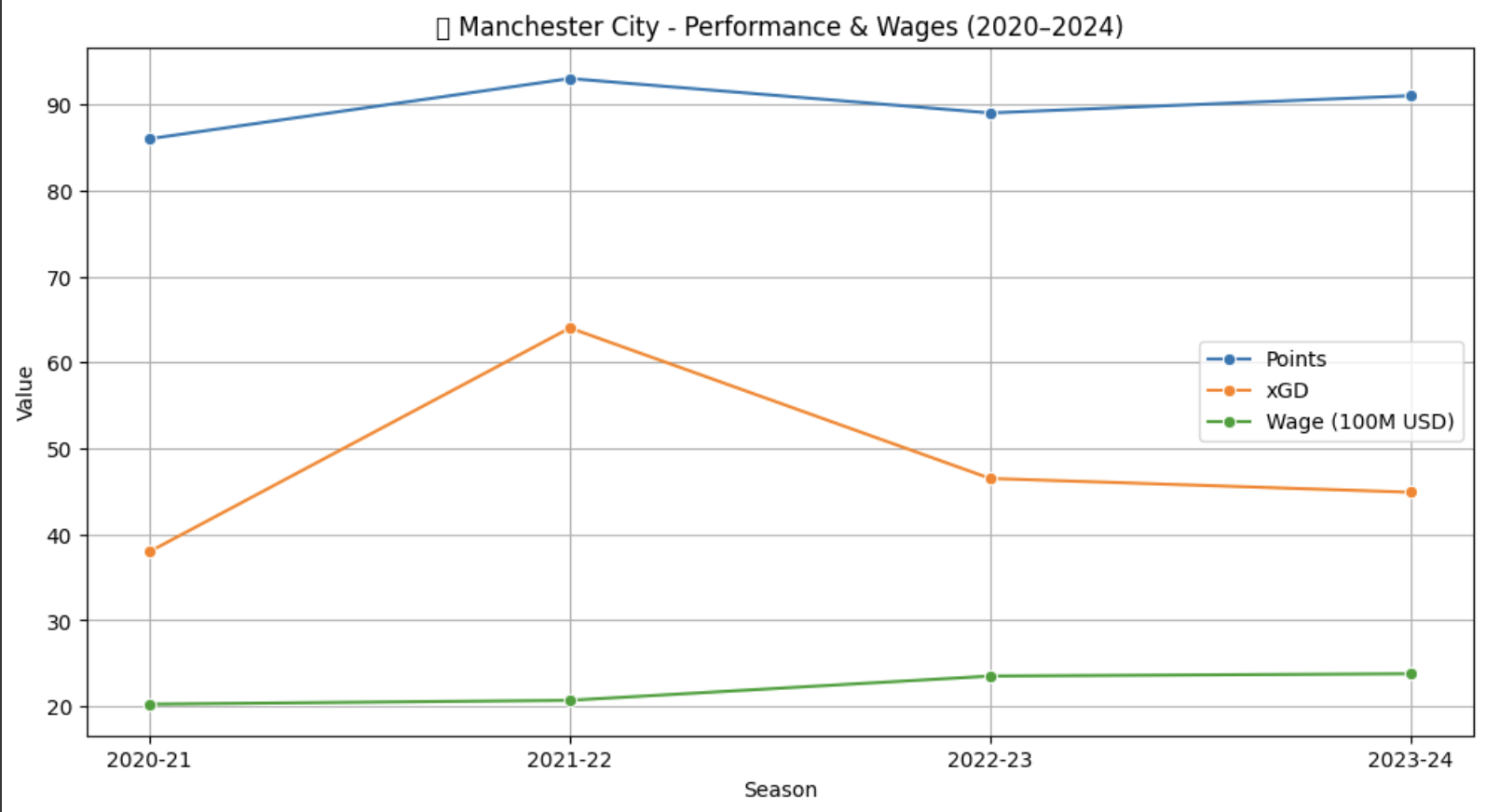

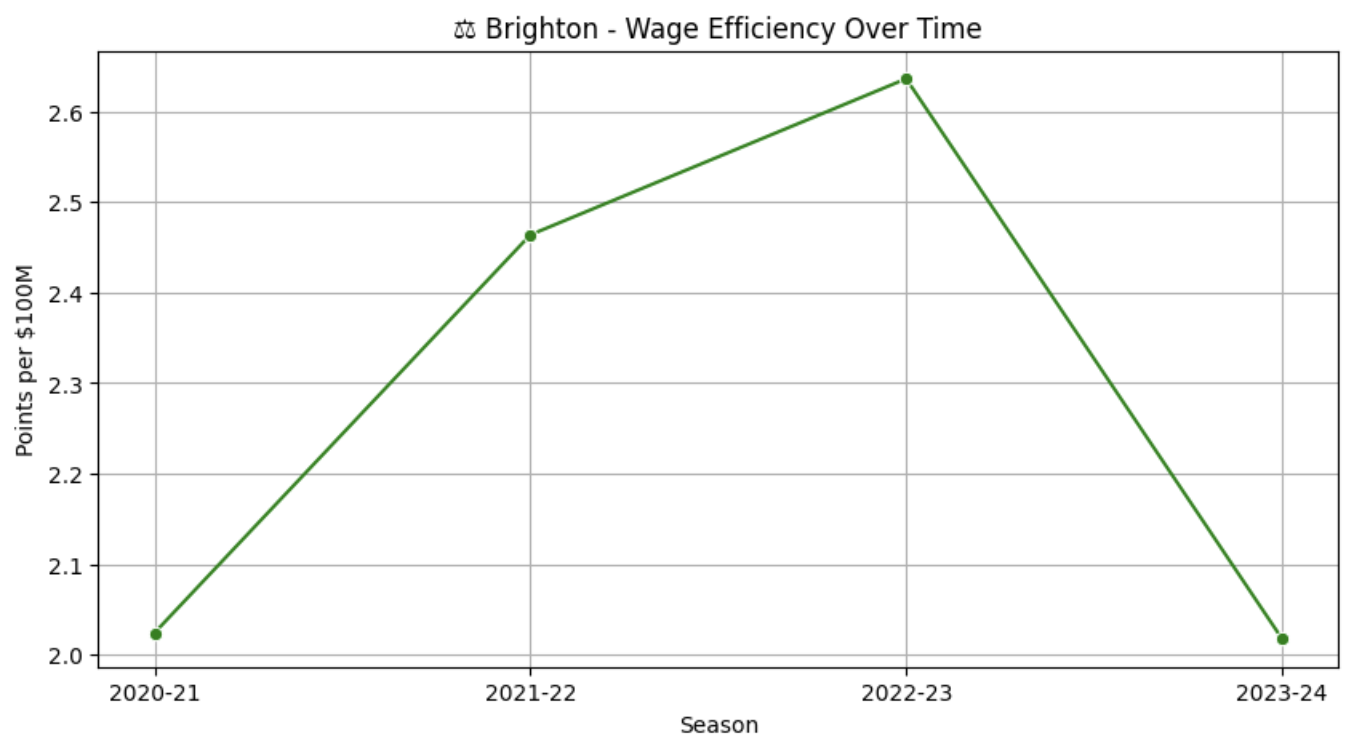

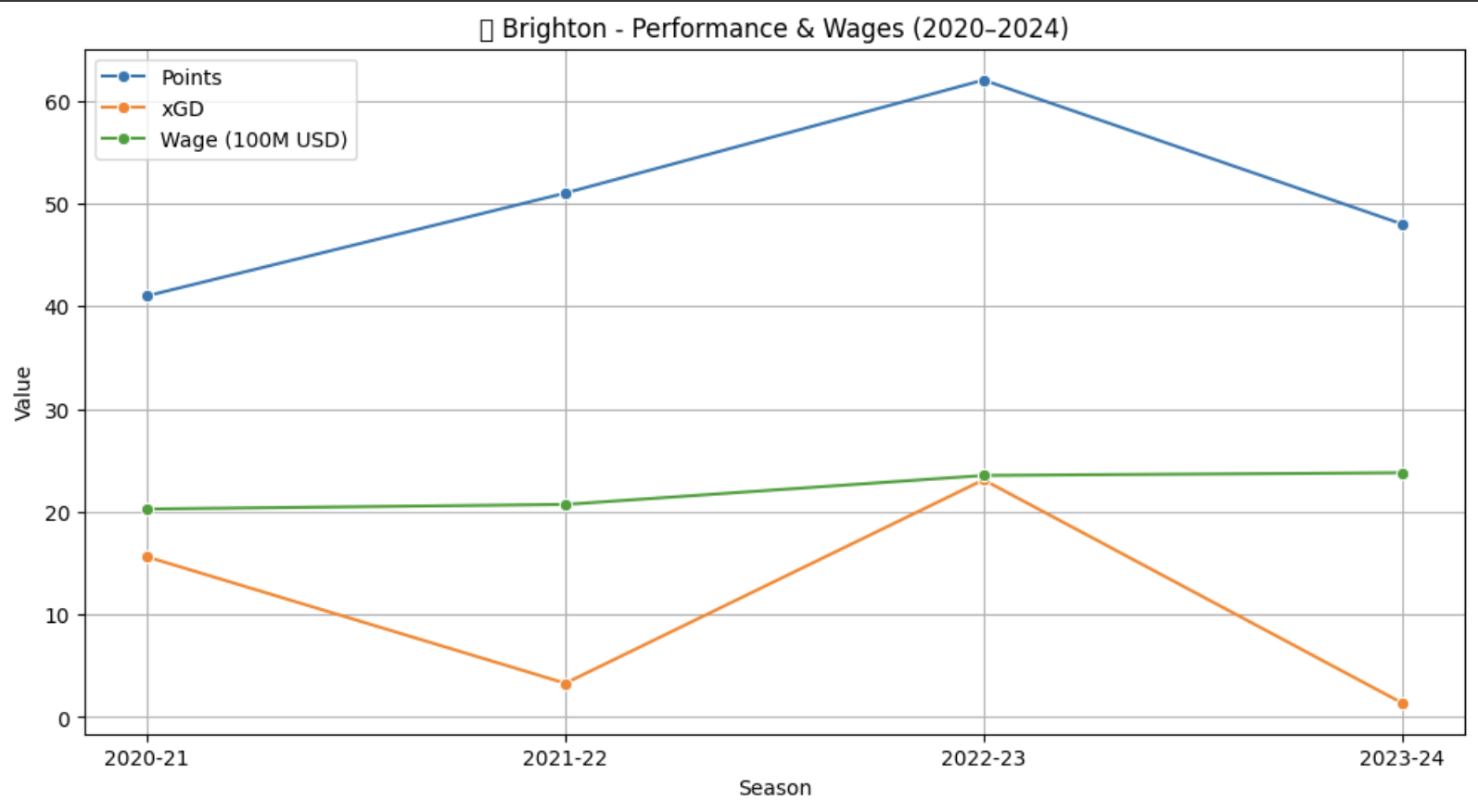

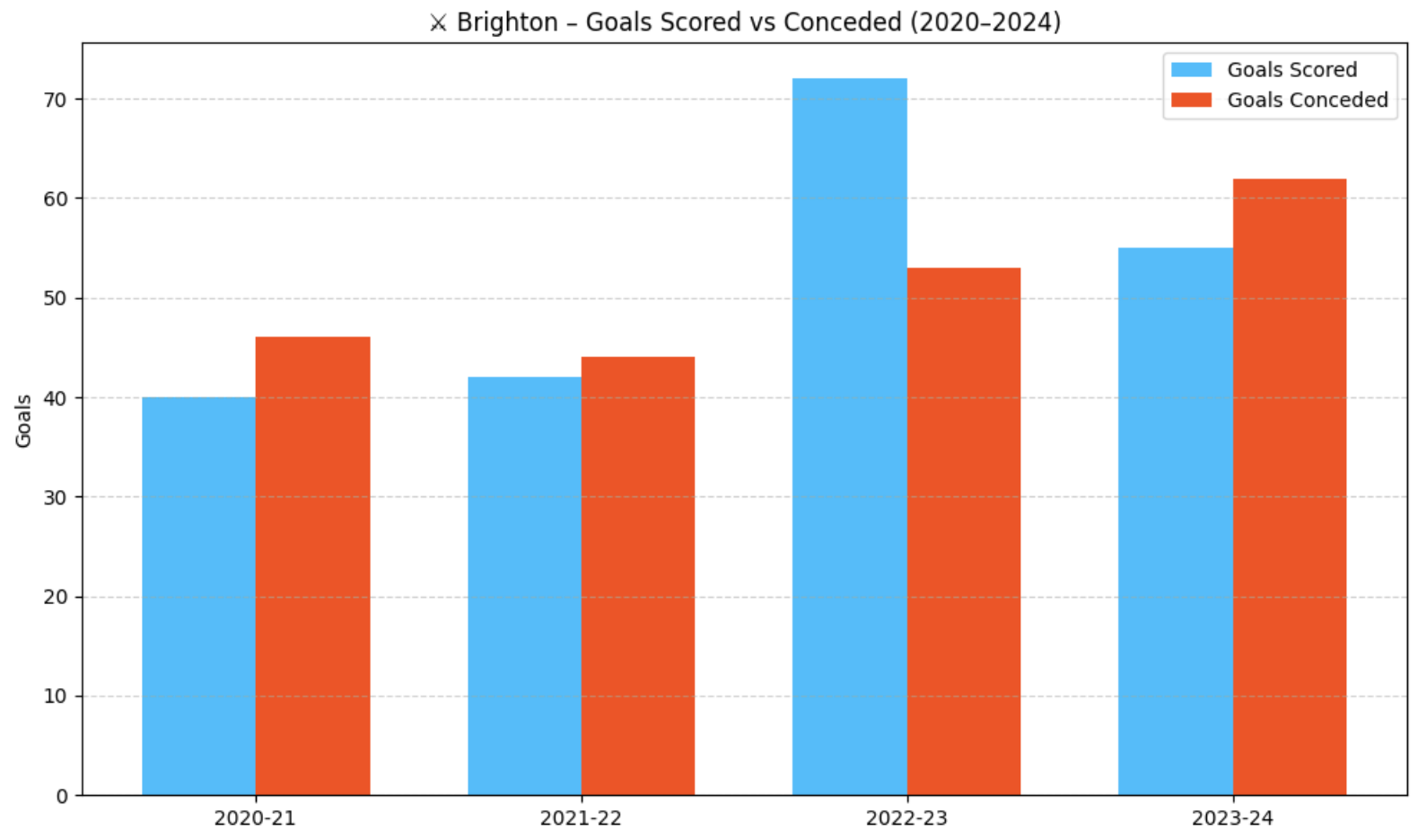

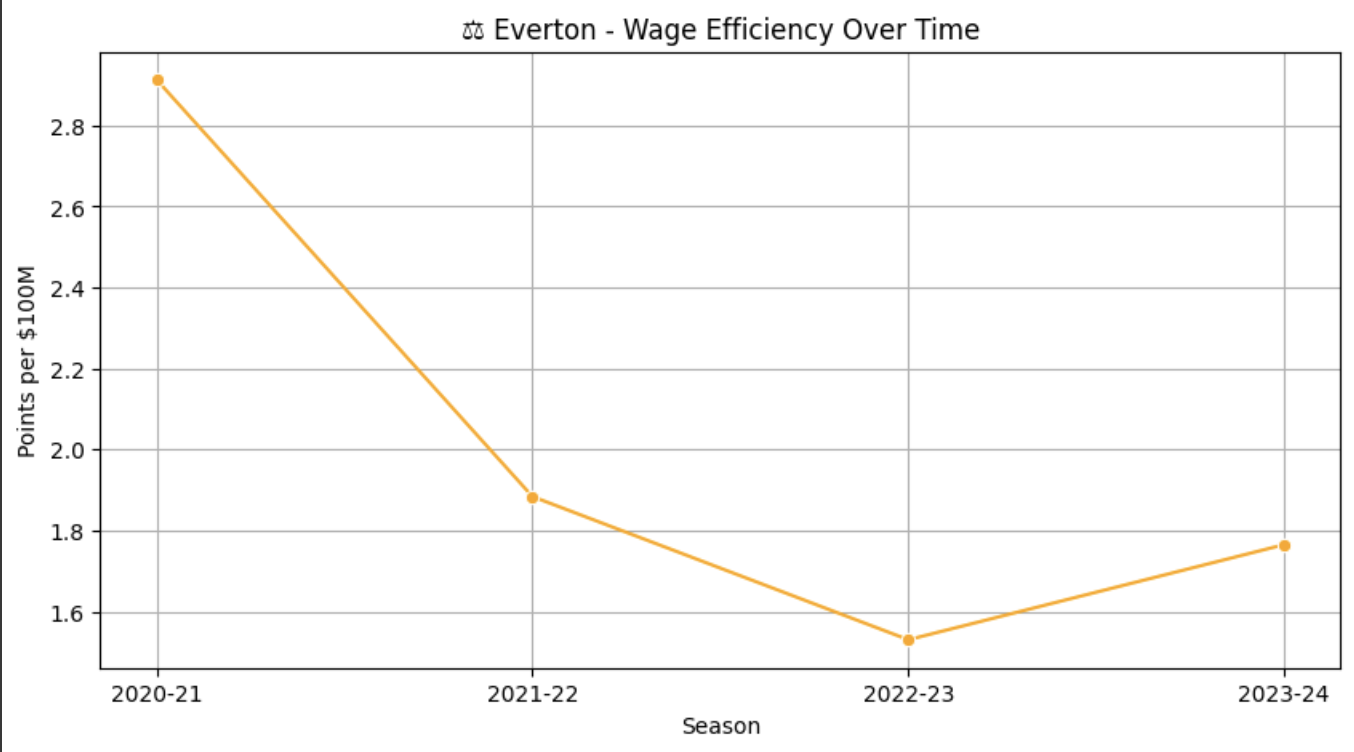

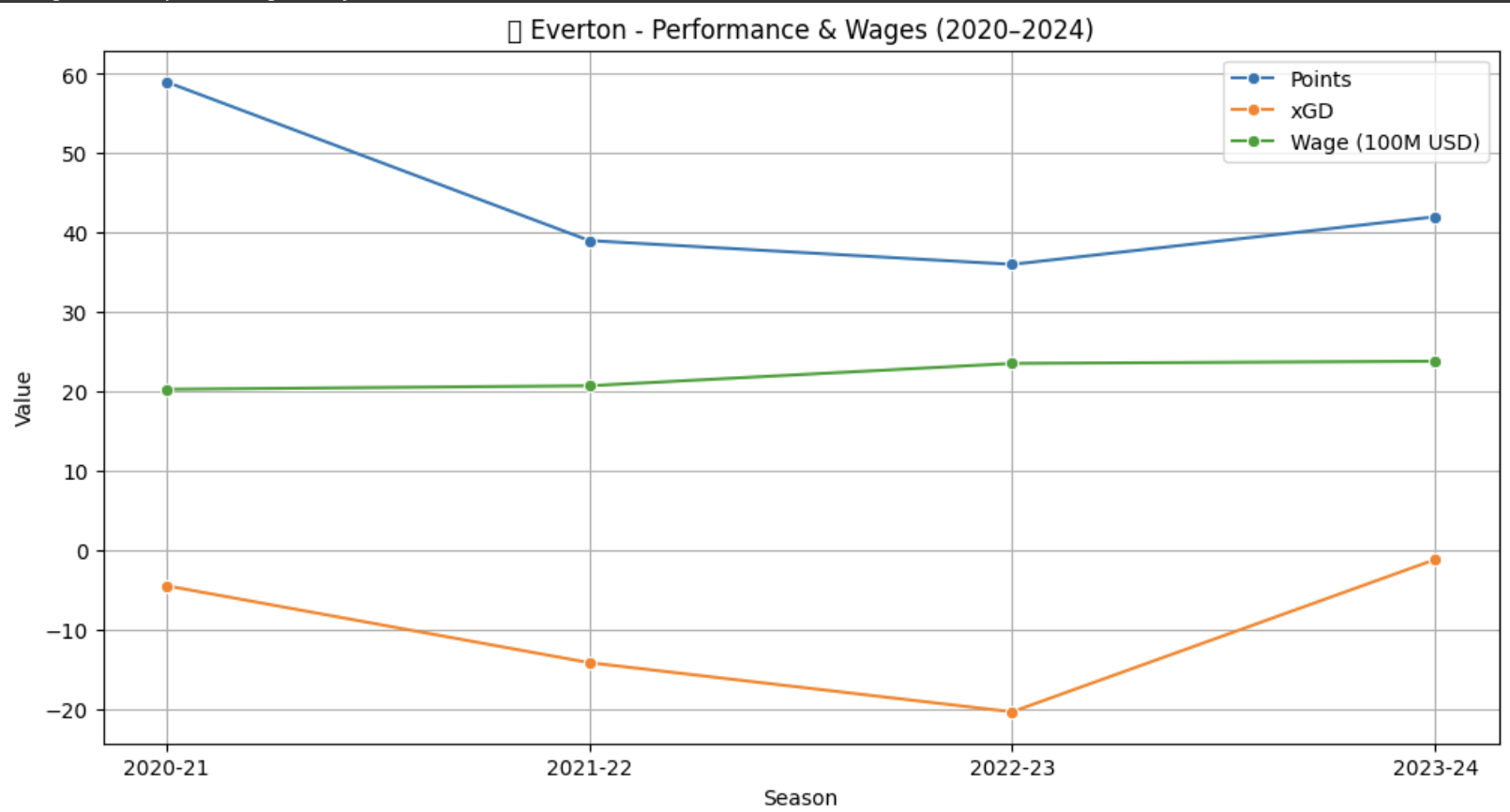

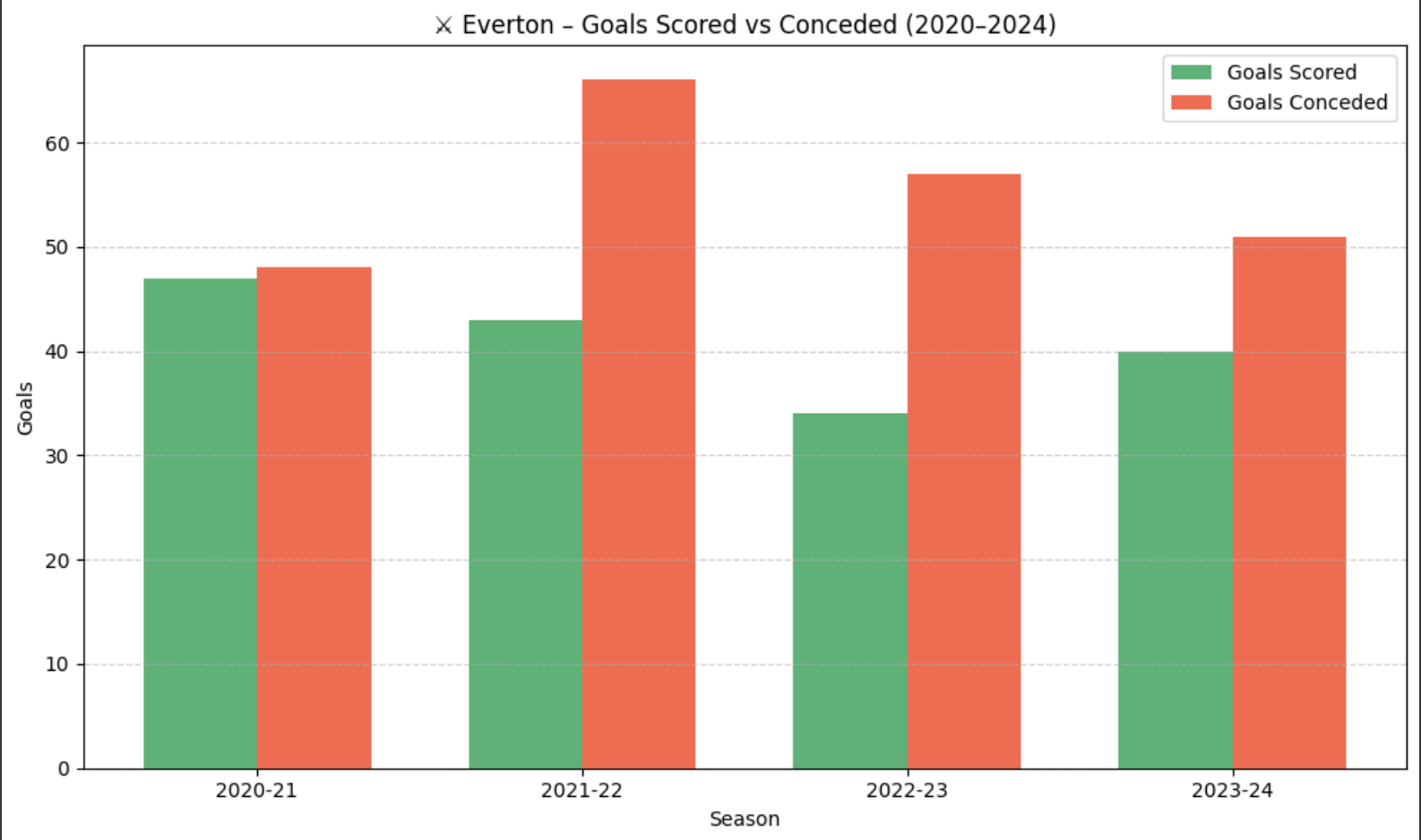

To identify clubs for deep analysis, we combined average league performance (points/season), injury cost, and financial efficiency metrics like WES, WPGC, and MVES.

We selected four teams that represent distinct case types: dominant efficient teams, budget overachievers, injury-affected underperformers, and smart spenders.

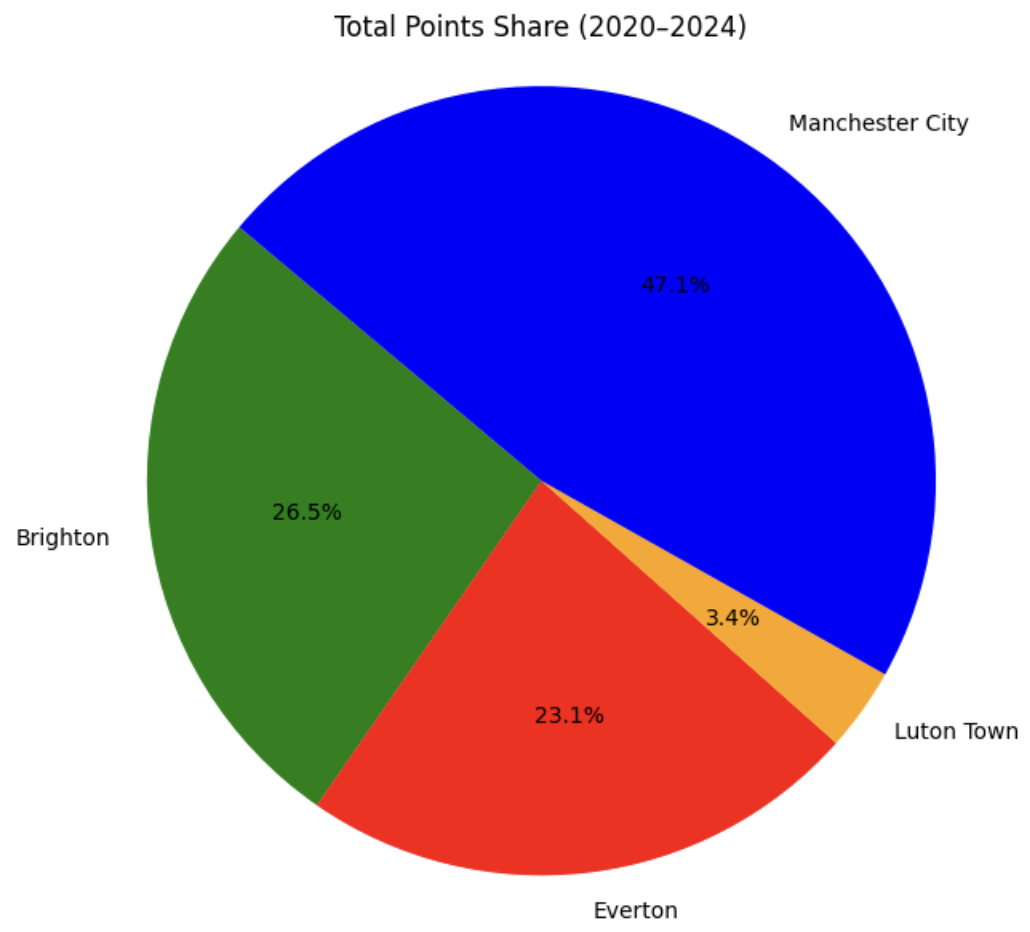

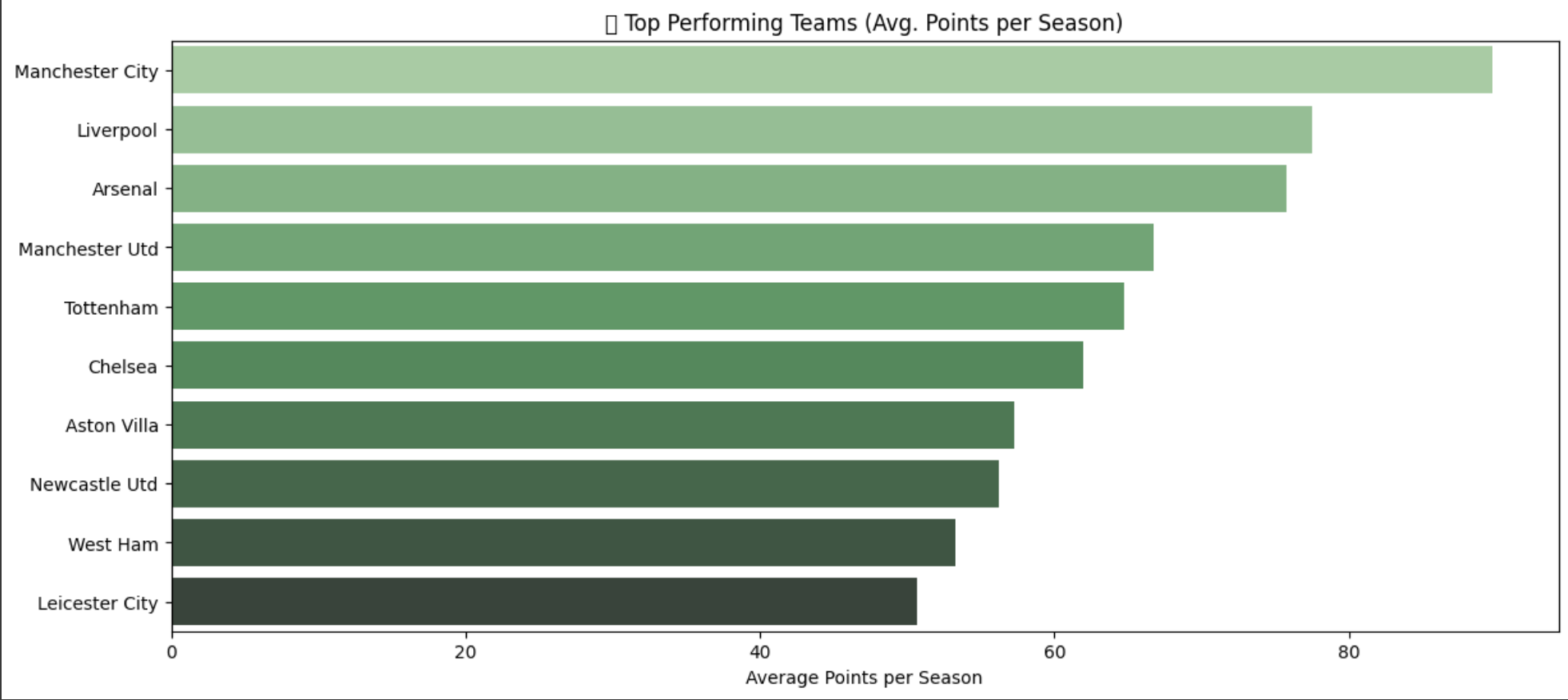

Top Performing Teams (Avg. Points/Season)

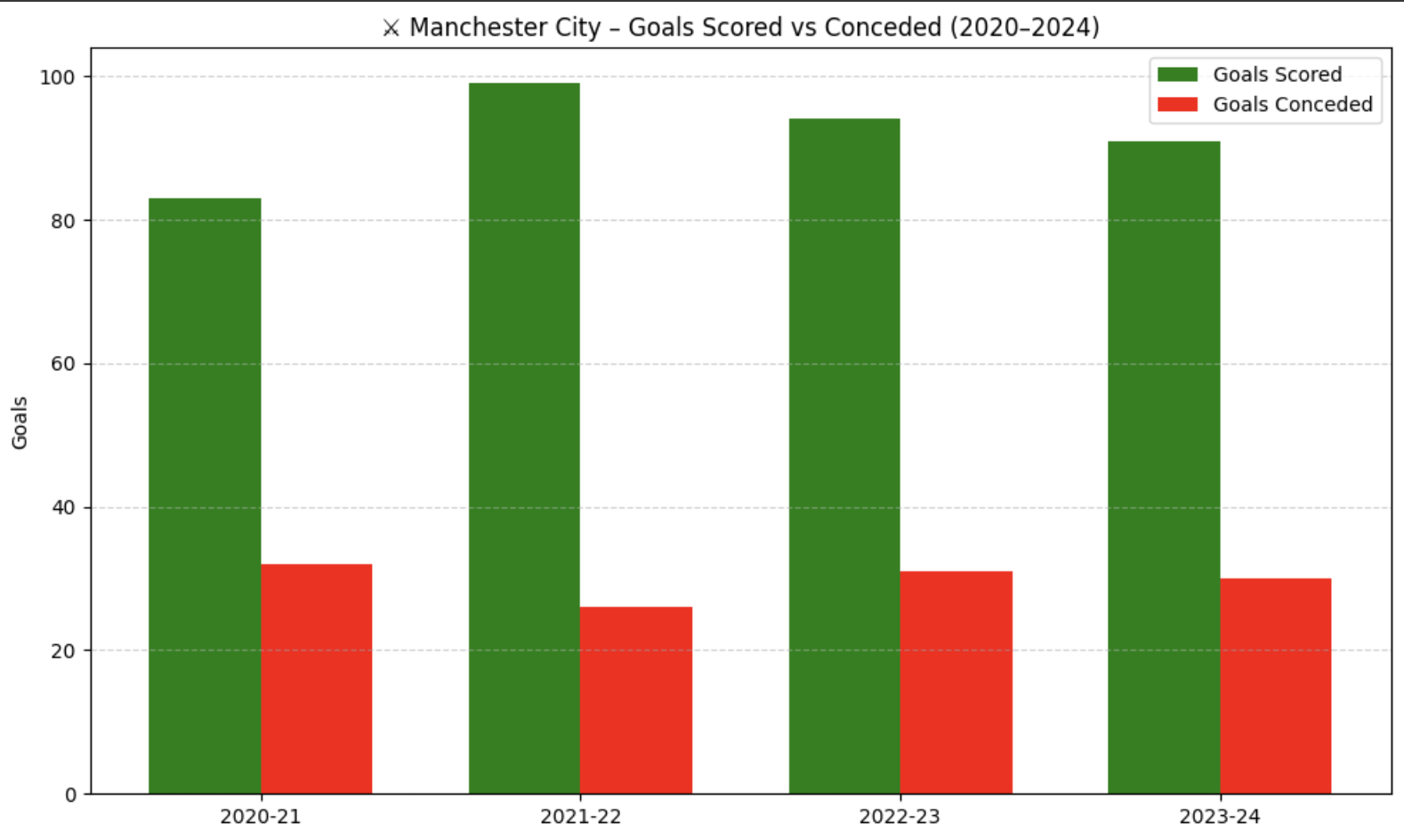

Teams like Manchester City, Liverpool, and Arsenal top the points table season after season. From our analysis, Manchester City stood out not just for performance but for low injury-related wage loss and strong Wage Efficiency Score (WES) — making them a perfect candidate to study sustained efficiency and squad depth.

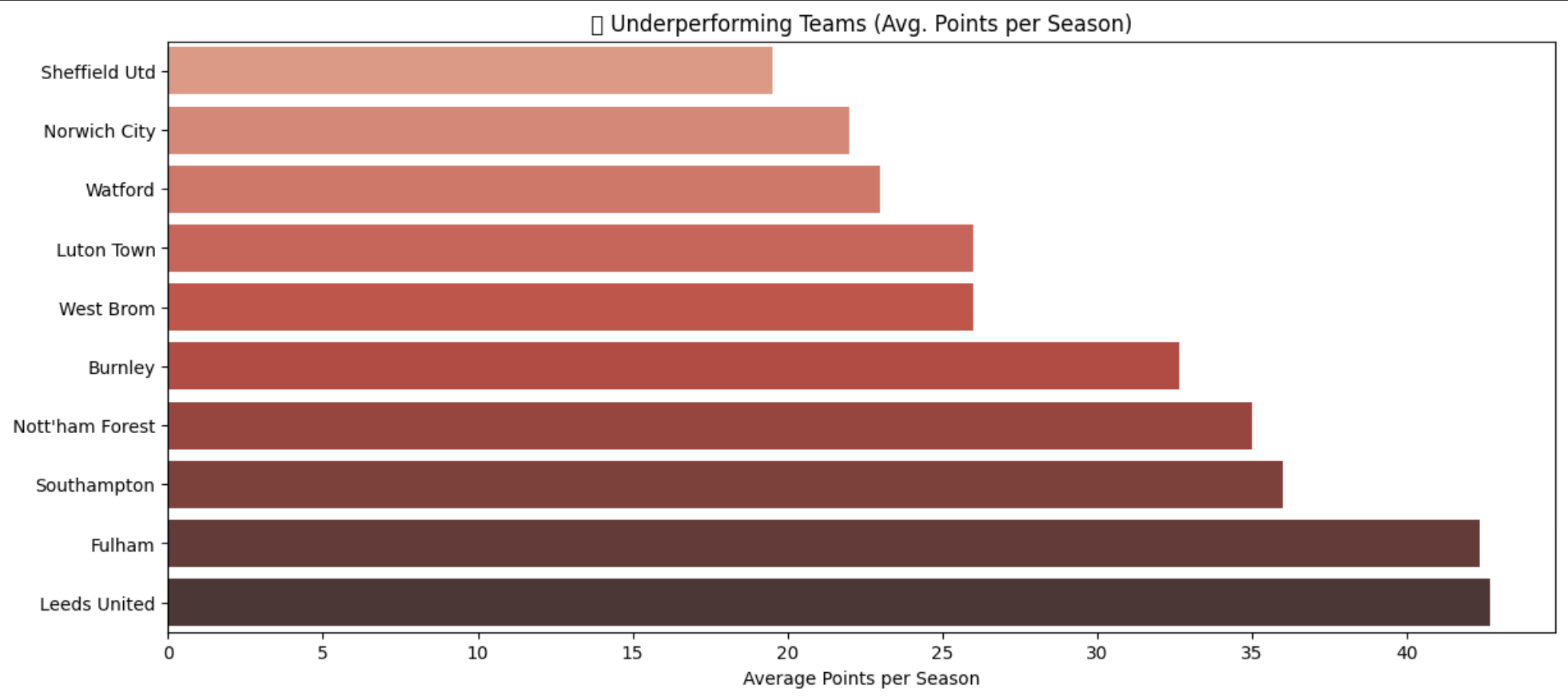

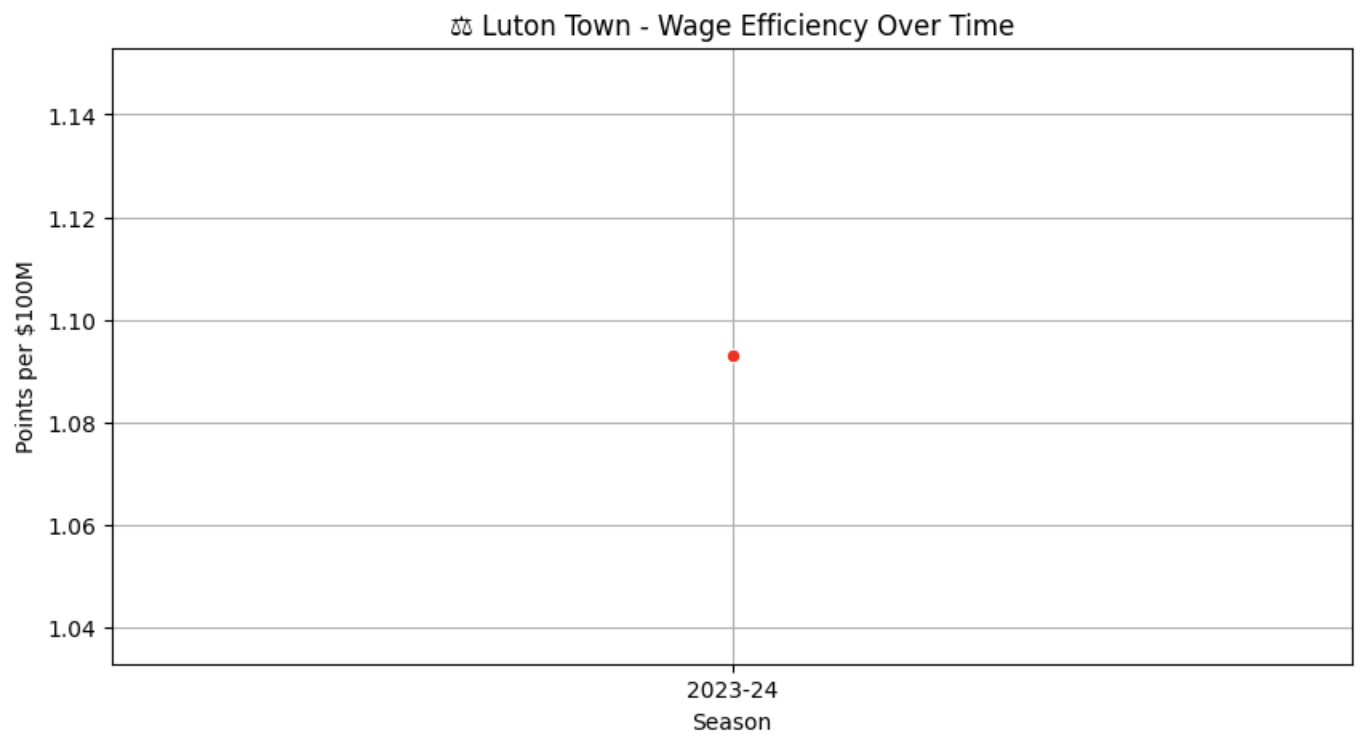

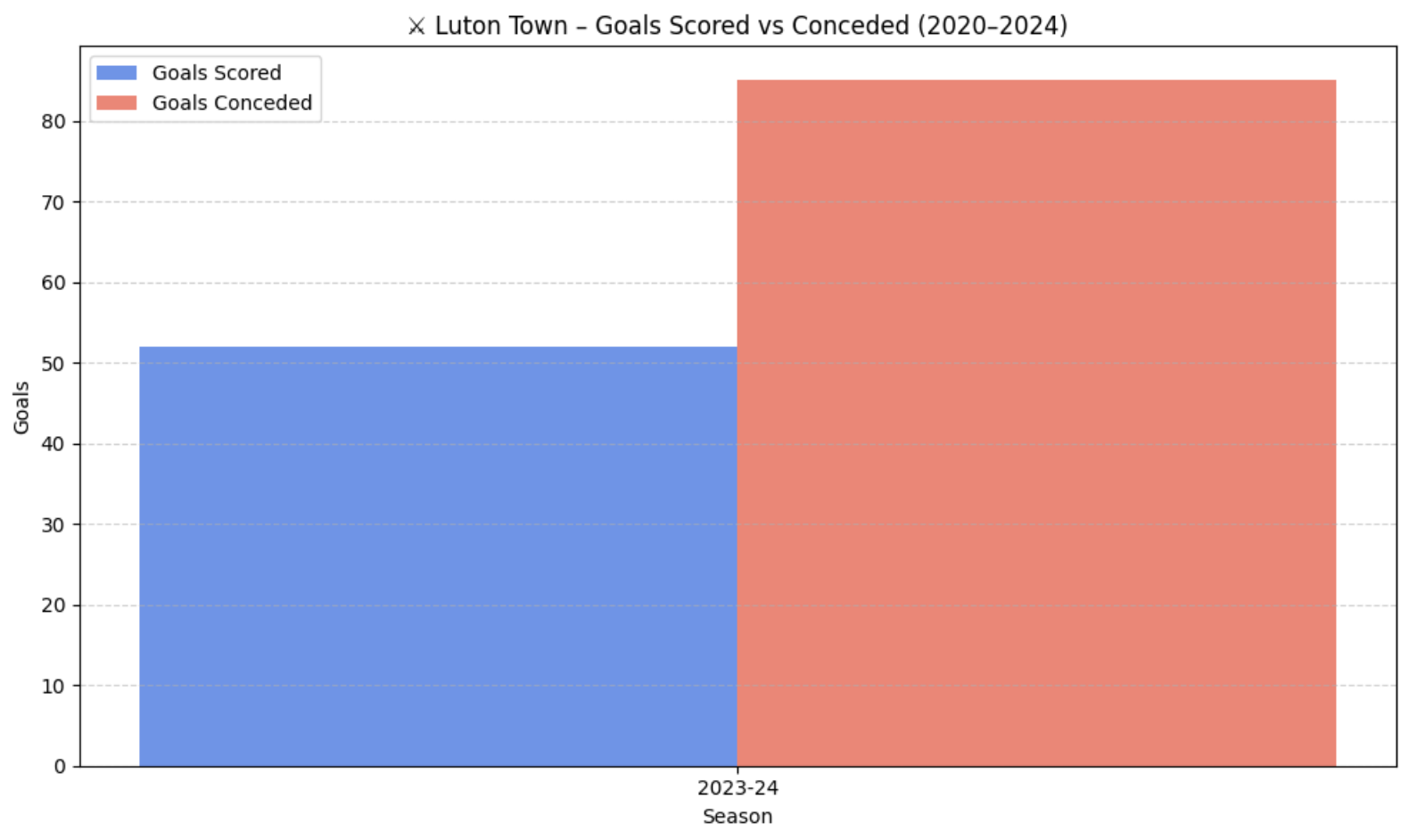

Underperforming Teams (Avg. Points/Season)

On the other end, clubs like Luton Town, Sheffield United, and Norwich show lower point averages. However, Luton Town surfaced as a fascinating case — despite being among the lowest earners, their cost-per-contribution ratios and squad value alignment were exceptional. A perfect example of overperformance on a tight budget.