🩺 EPL Injury Impact: Risk, Cost & Value Loss

Explore the deeper financial and tactical implications of player injuries in the Premier League. From risk tiers to wage loss and market impact — here’s what the data reveals.

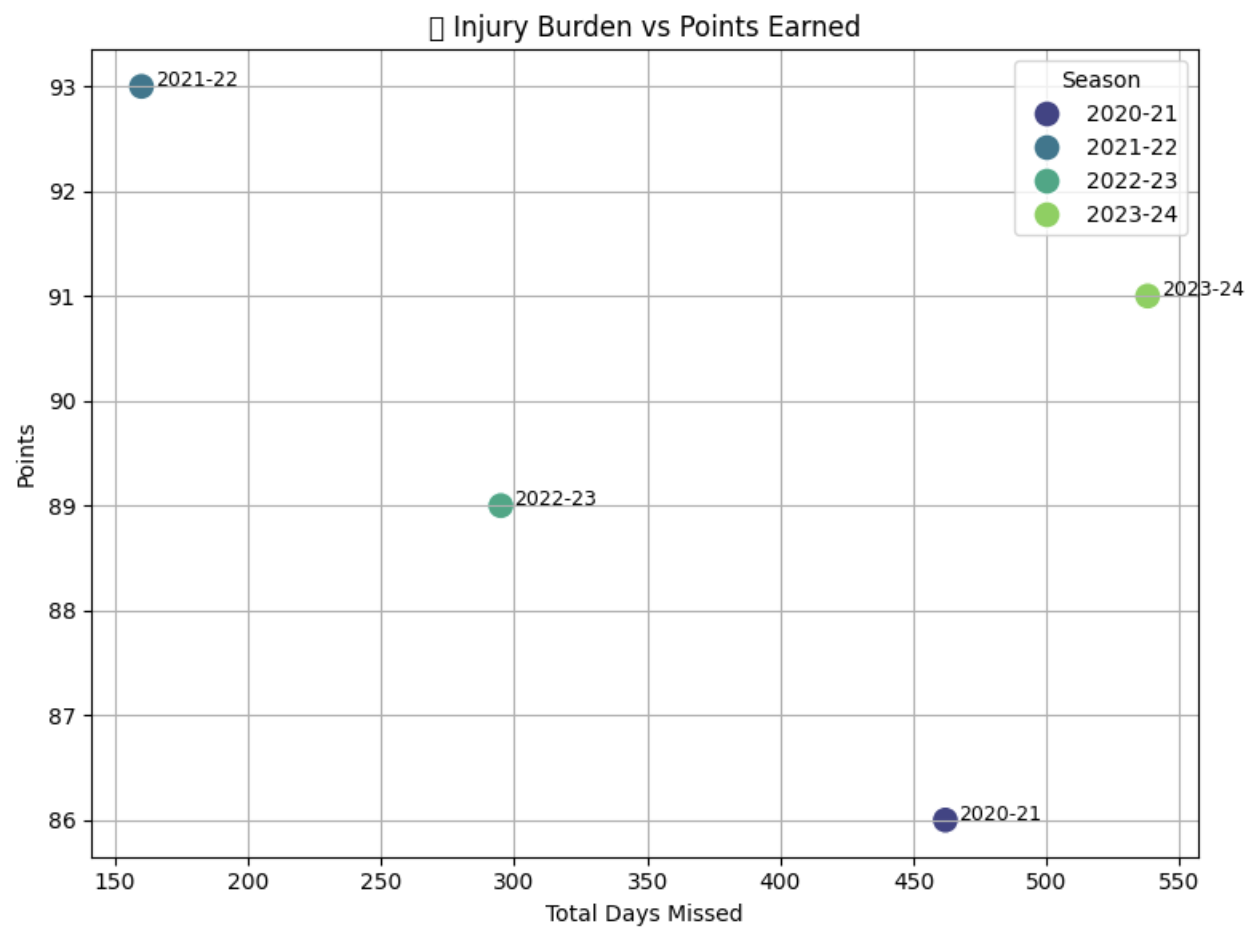

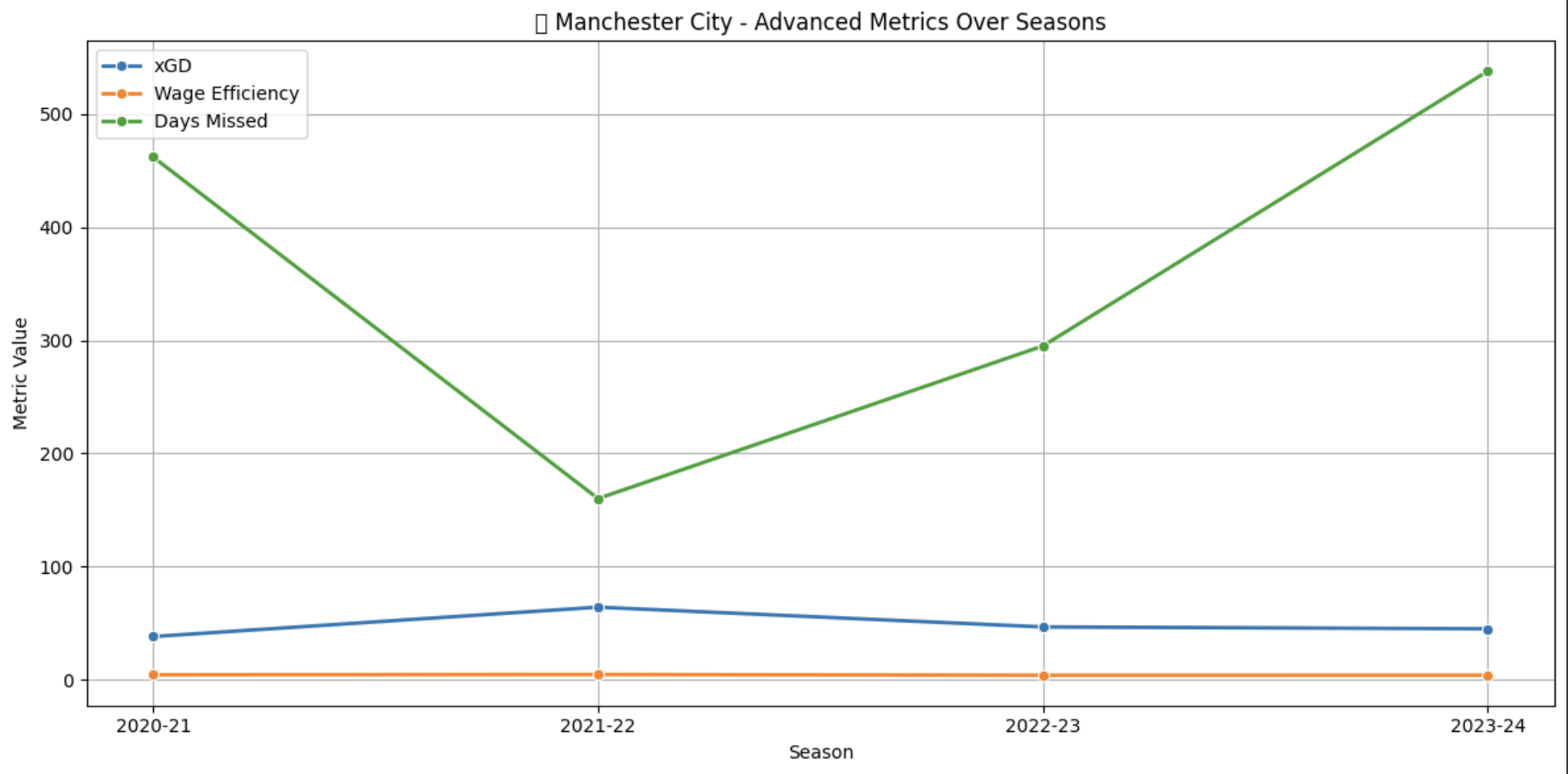

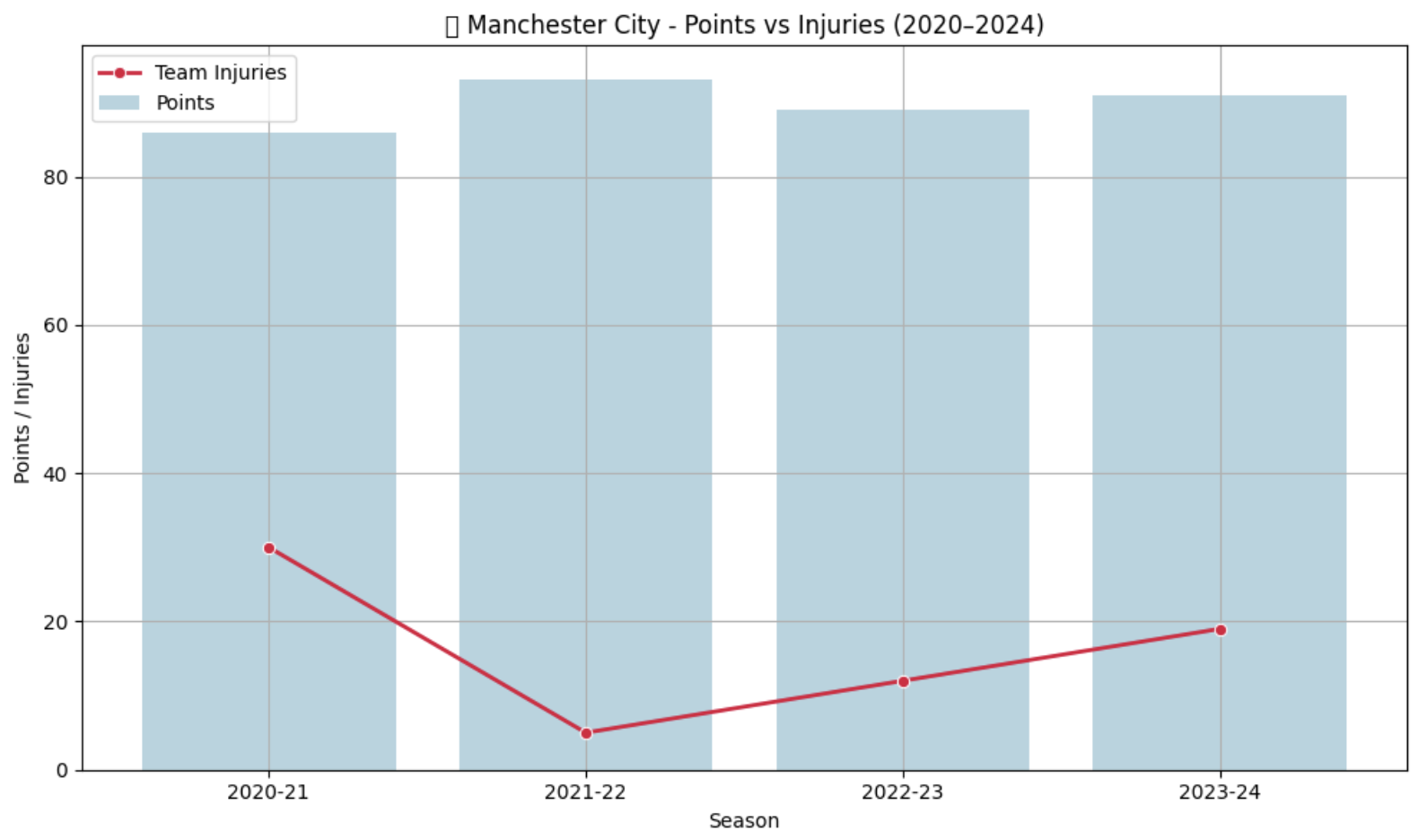

Manchester City

High performance despite injury disruptions. See how minimal wage loss kept their dominance intact.

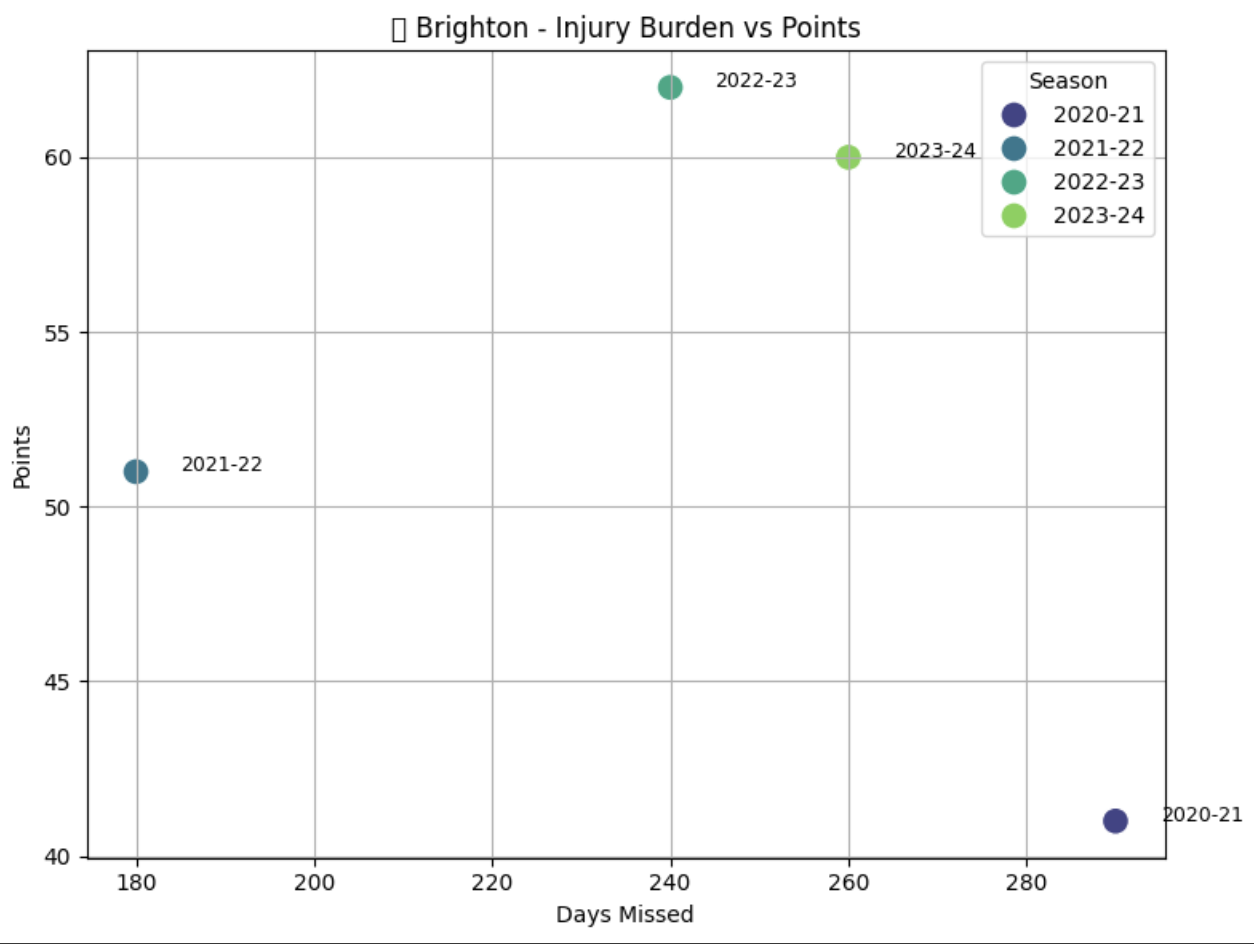

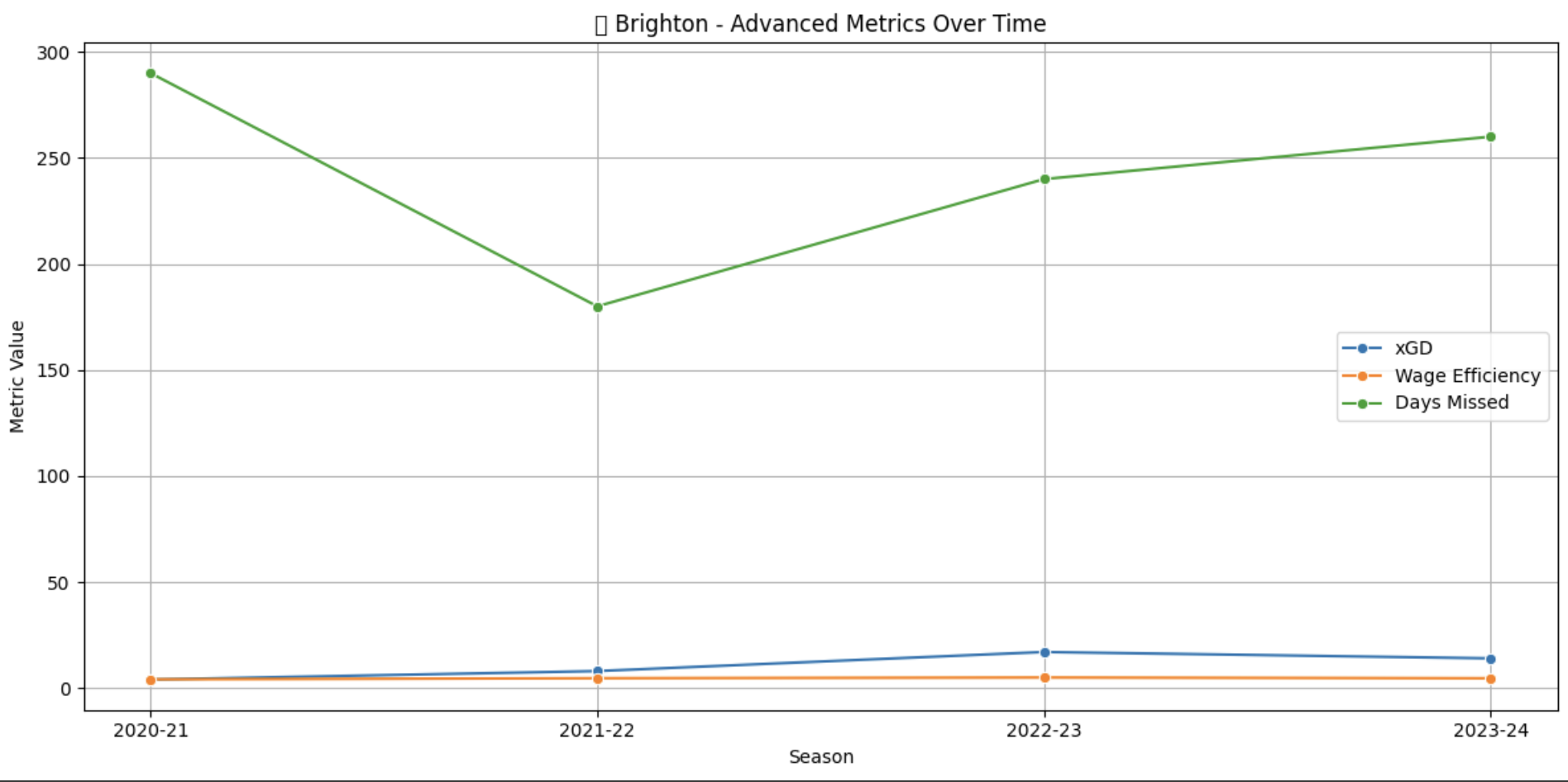

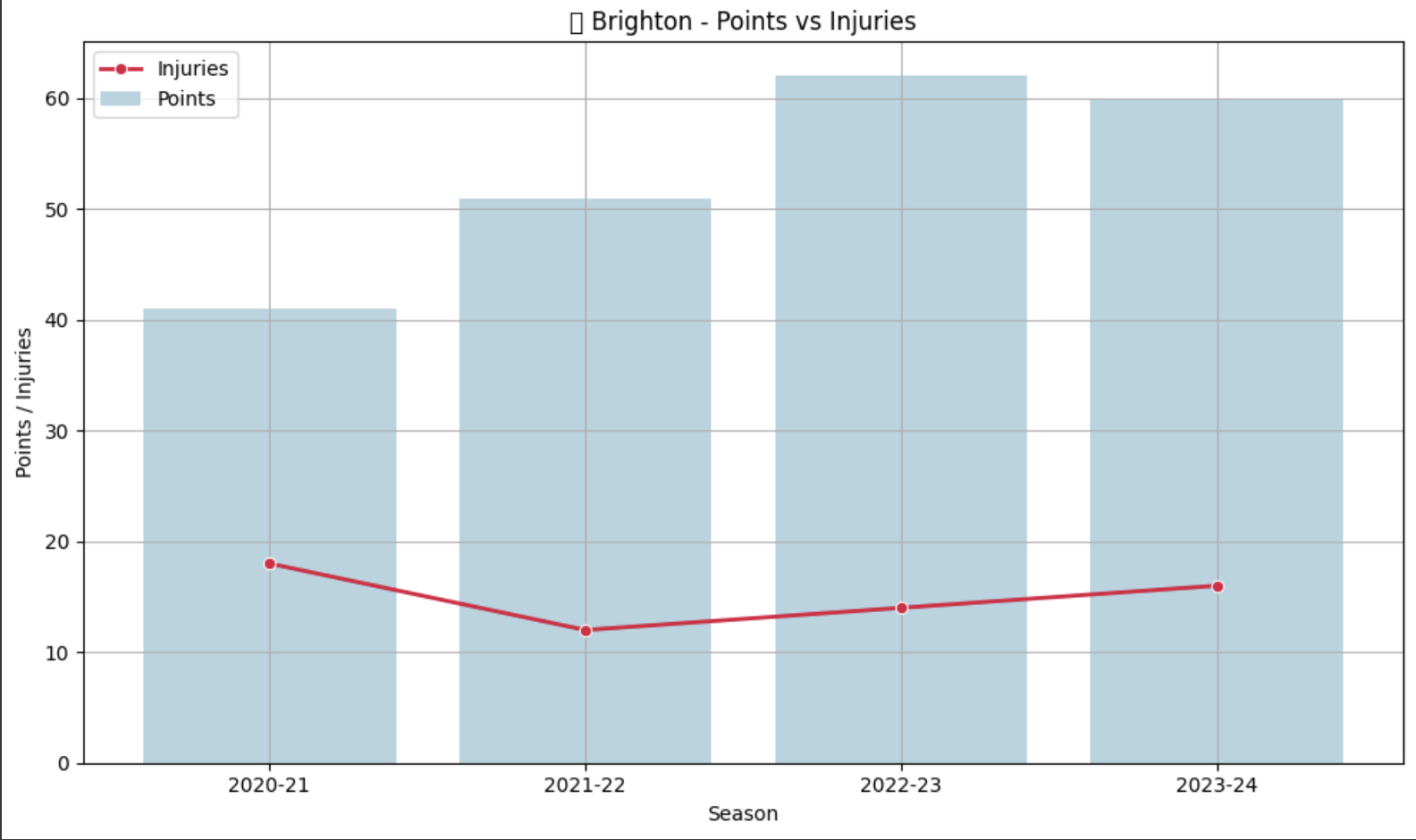

View Insights →Brighton

Small injuries, big effect. Discover how Brighton managed risk and maximized value from their lean squad.

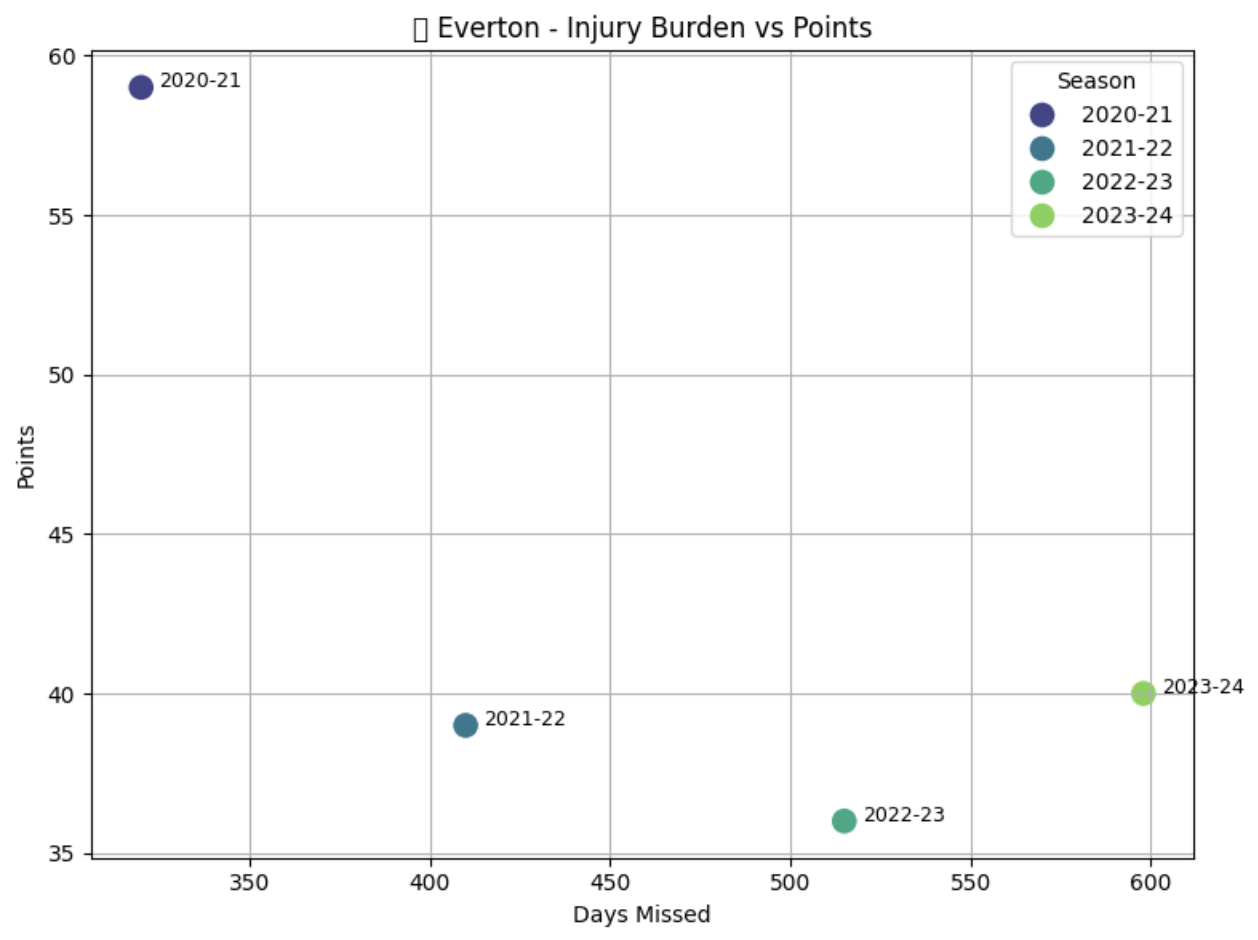

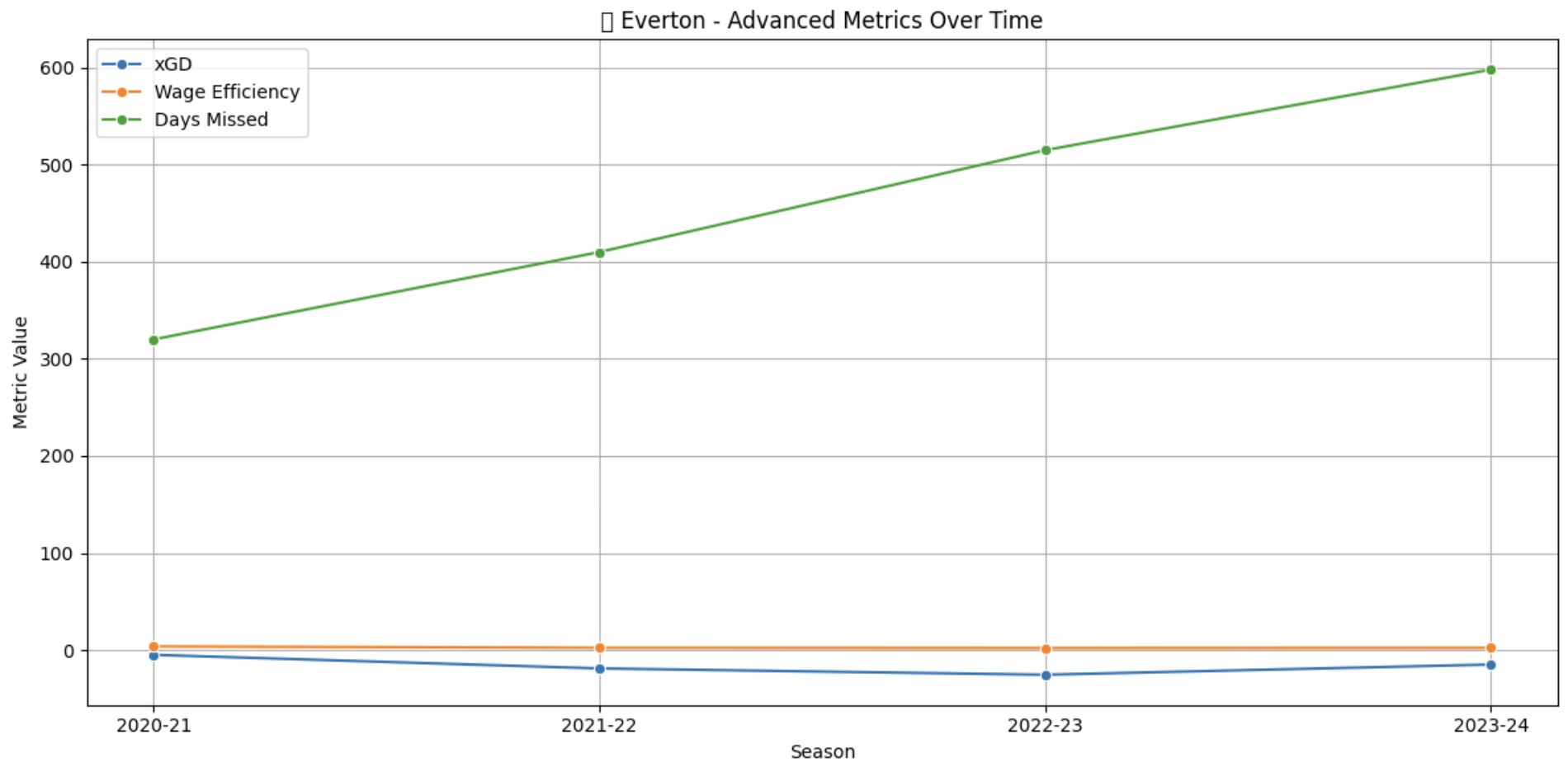

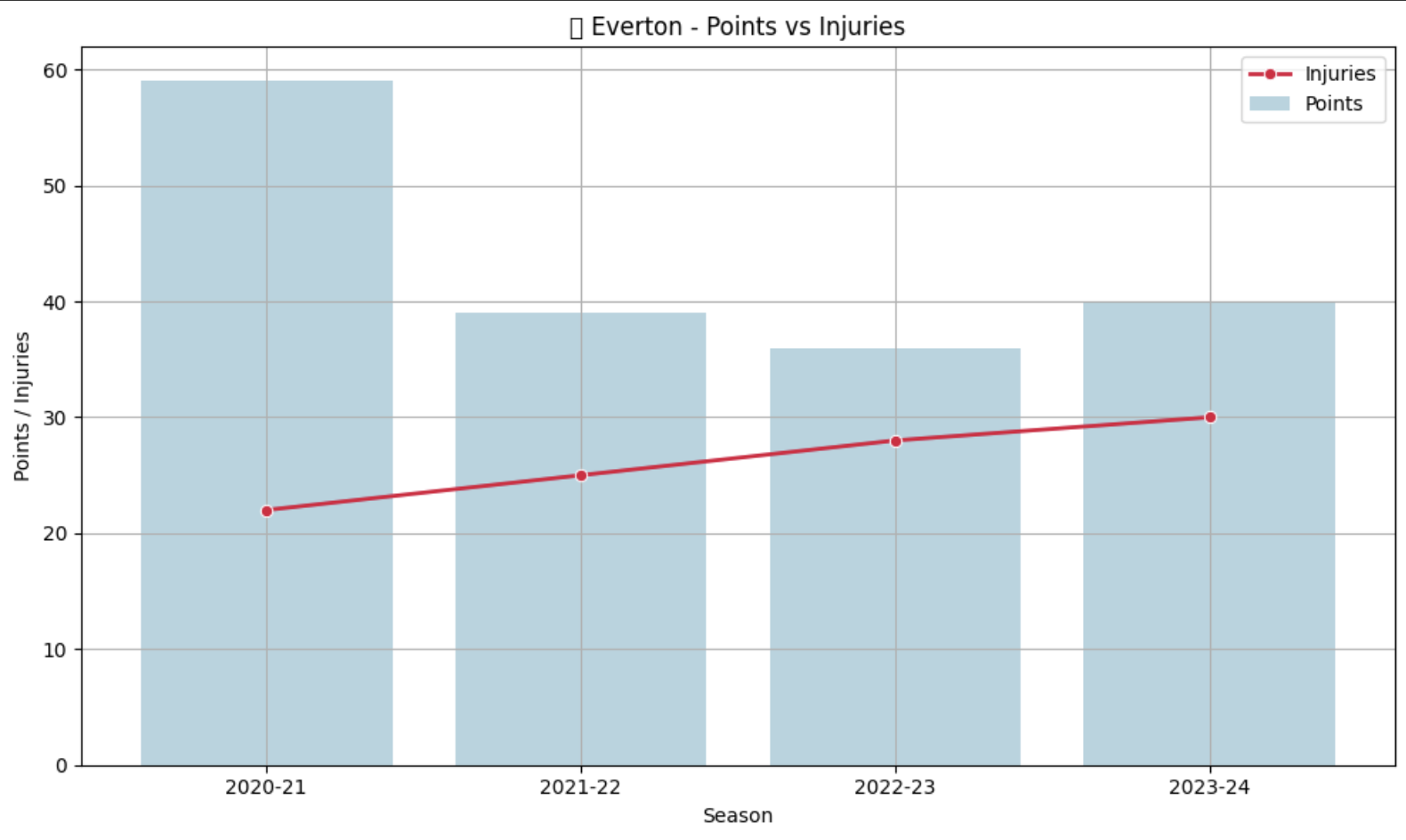

View Insights →Everton

A wage-heavy squad hit by recurrent injuries. Check how it derailed their campaign.

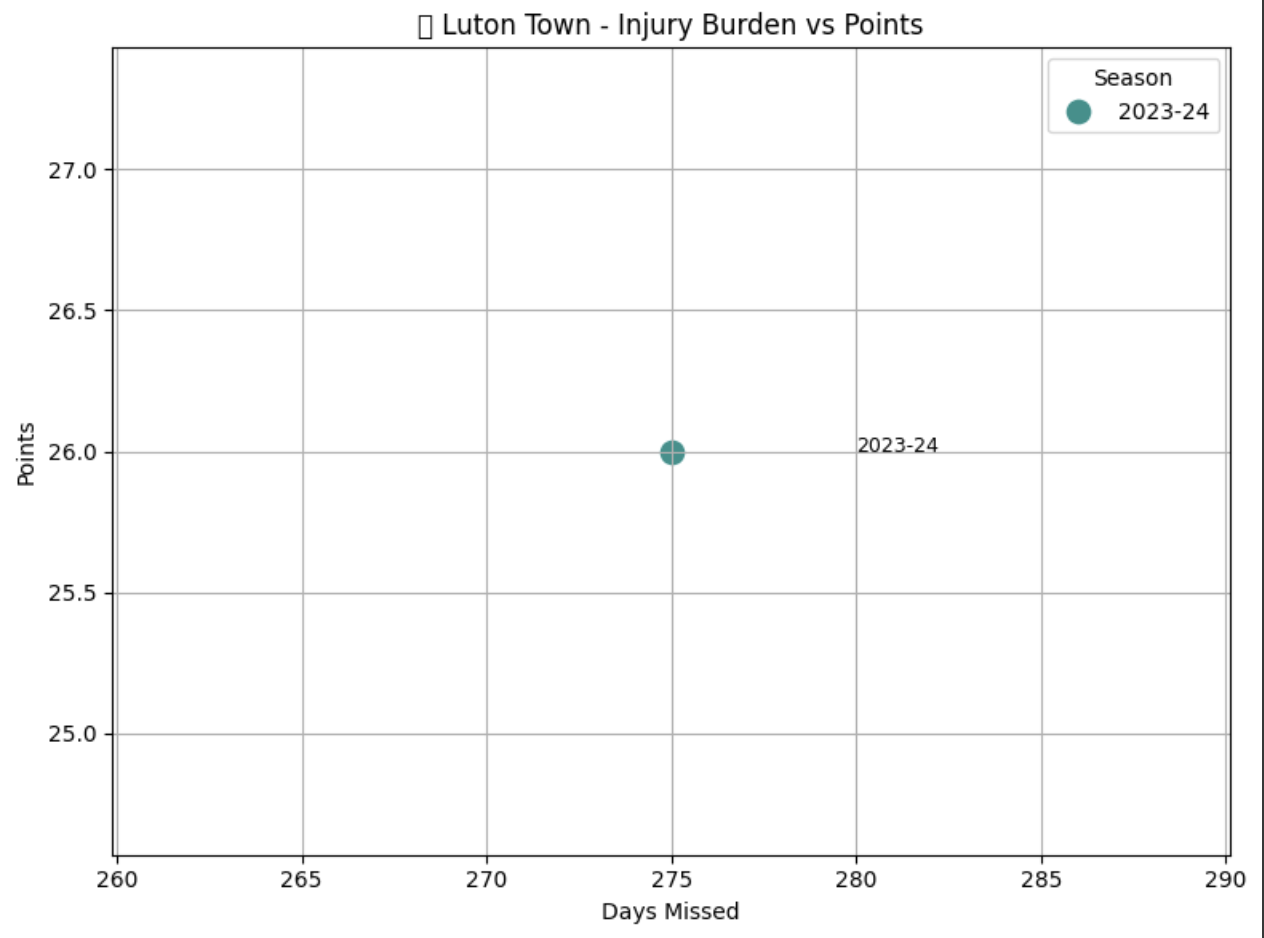

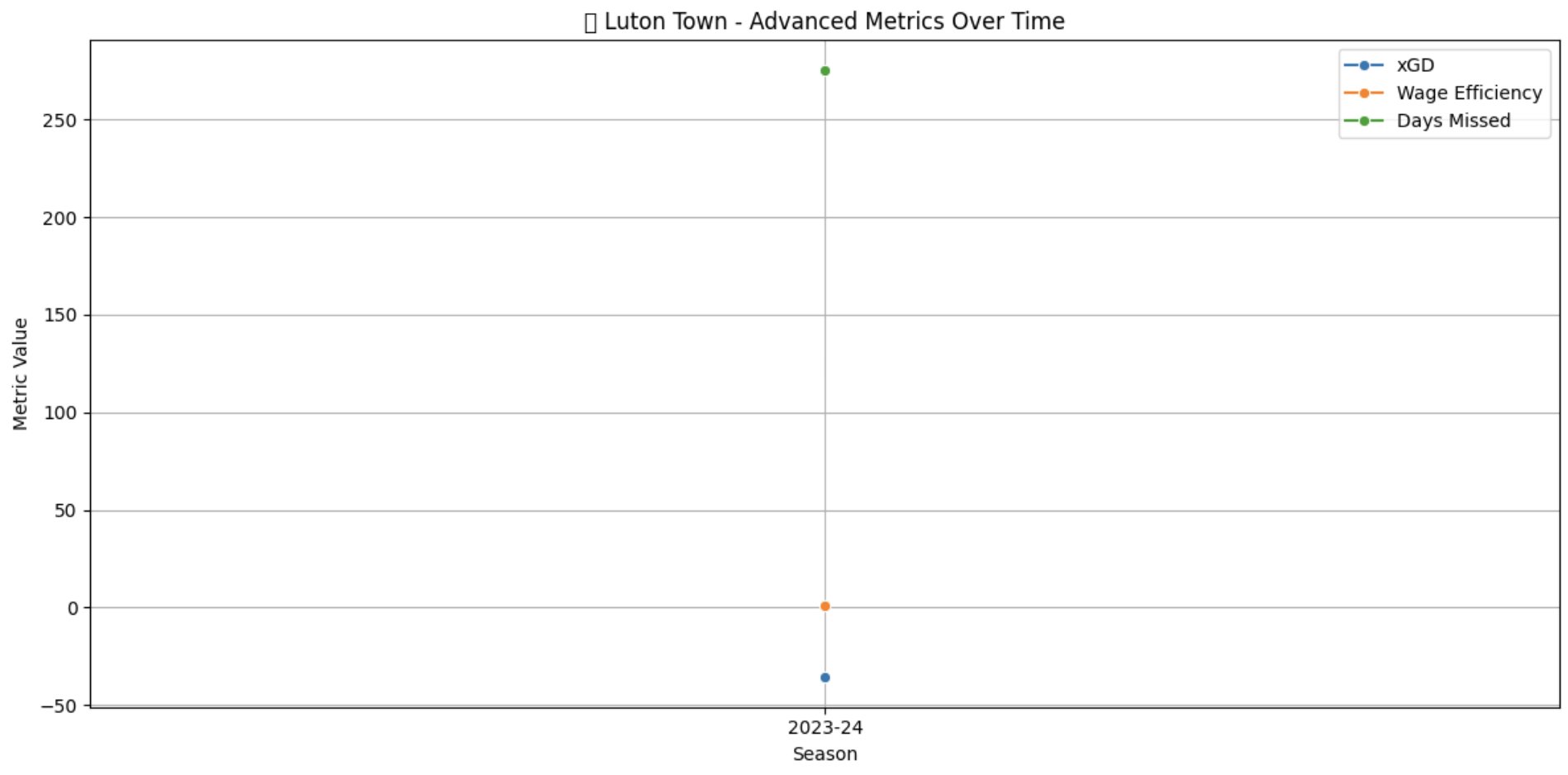

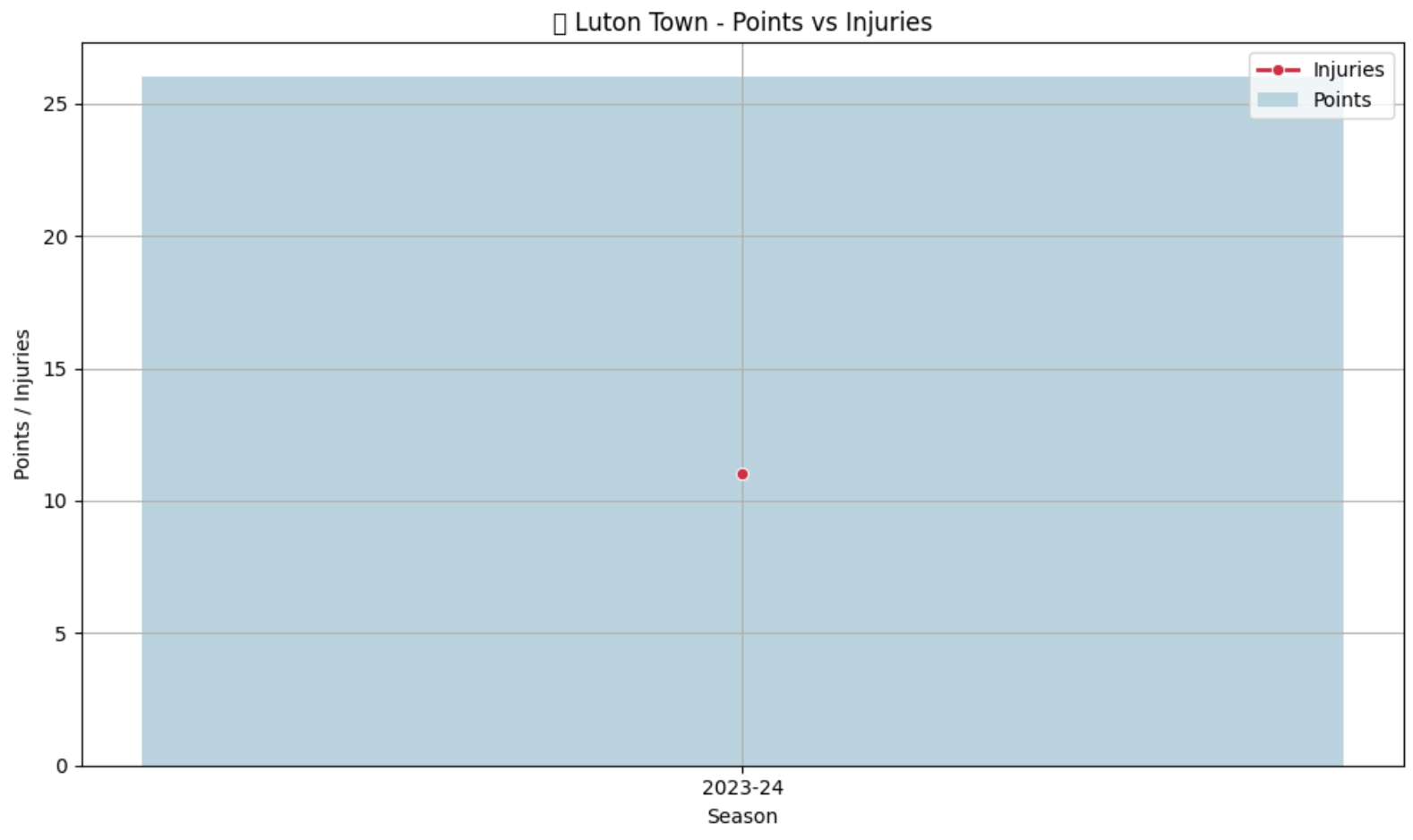

View Insights →Luton Town

Operating on a shoestring, even minor injuries shook stability. See their survival story.

View Insights →

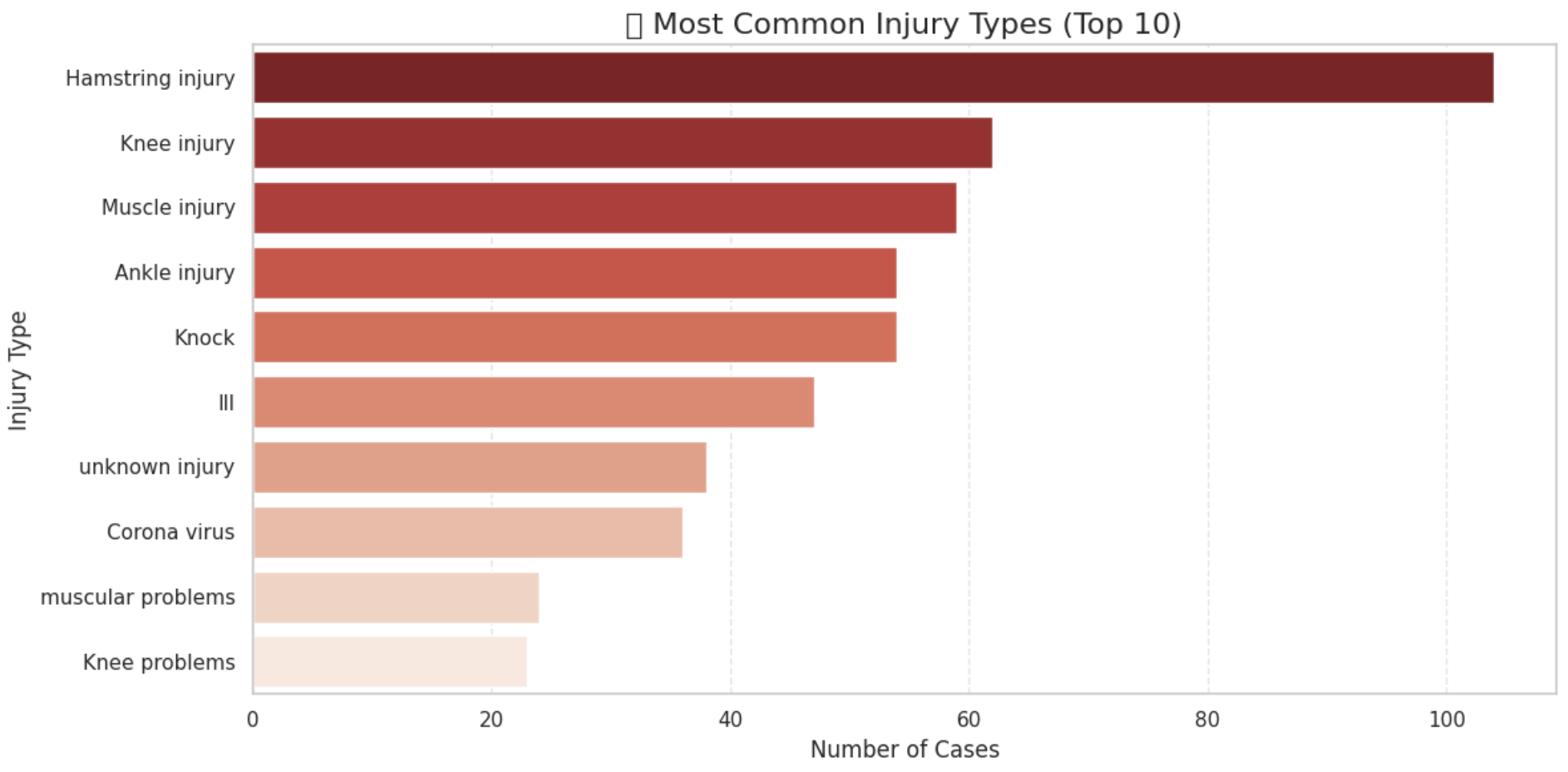

🩹 Most Common Injury Types (Top 10)

Hamstring injuries dominated the EPL injury charts from 2020 to 2024, with over 100 recorded instances, far surpassing knee and muscle injuries. These soft-tissue injuries tend to have longer recovery times and a higher recurrence risk, often affecting high-speed sprinting players like wingers and full-backs.

Other frequent injuries include ankle issues, knocks, and even post-pandemic effects like “illness” and “Corona virus,” highlighting how health crises and intense fixture schedules contributed to diverse injury profiles across squads.

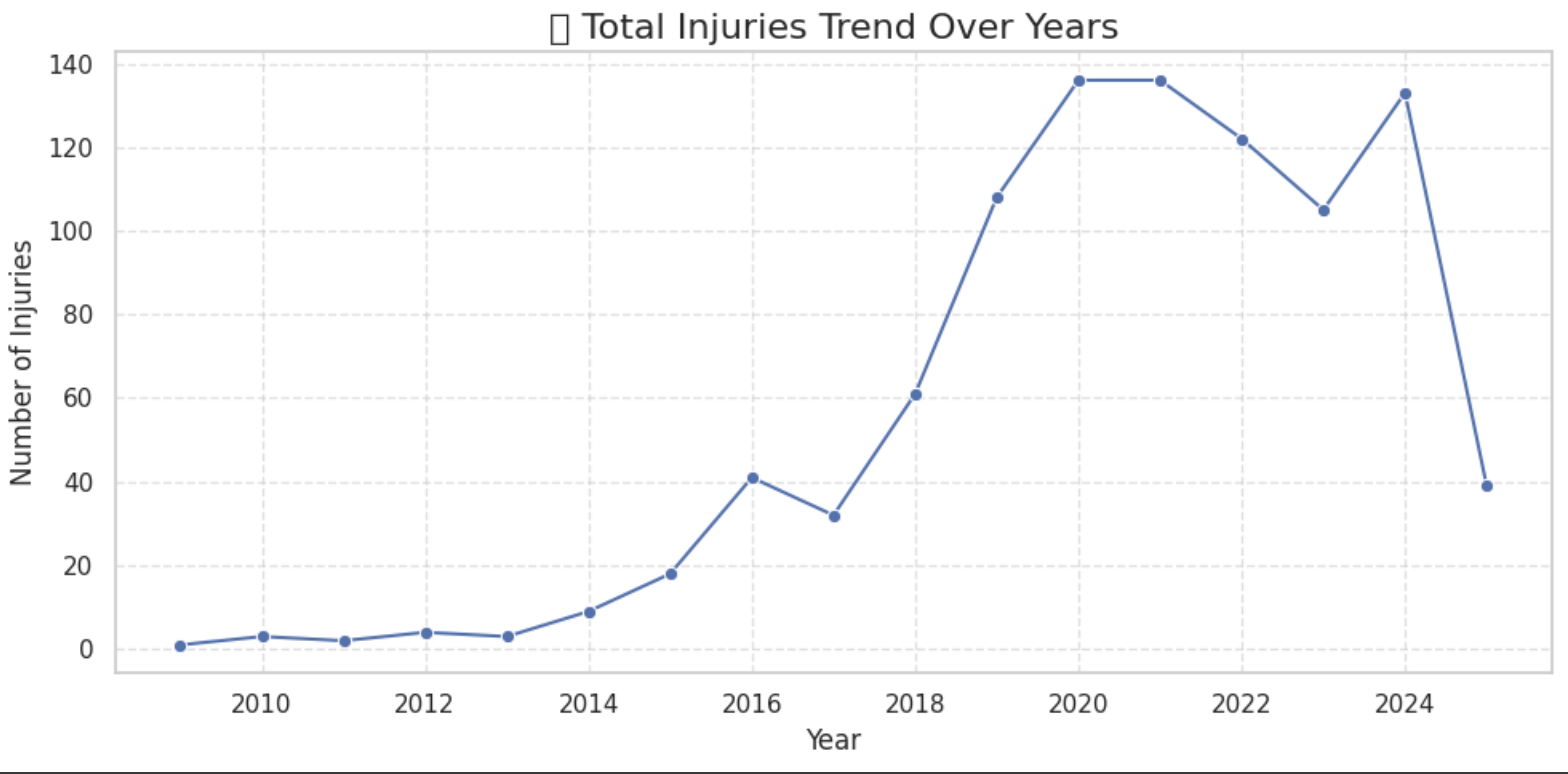

📉 Total Injuries Trend Over Years

The yearly injury trend reveals a sharp uptick starting in 2018, peaking during the 2020–2021 seasons—closely aligned with post-COVID fixture congestion and compressed tournament calendars. Over 130 injuries were recorded in those peak years.

While there was a minor dip in 2022, injuries remained elevated, with 2024 showing another spike. This persistent high volume raises concerns around player workload, rotation policies, and the need for modern injury prevention practices.

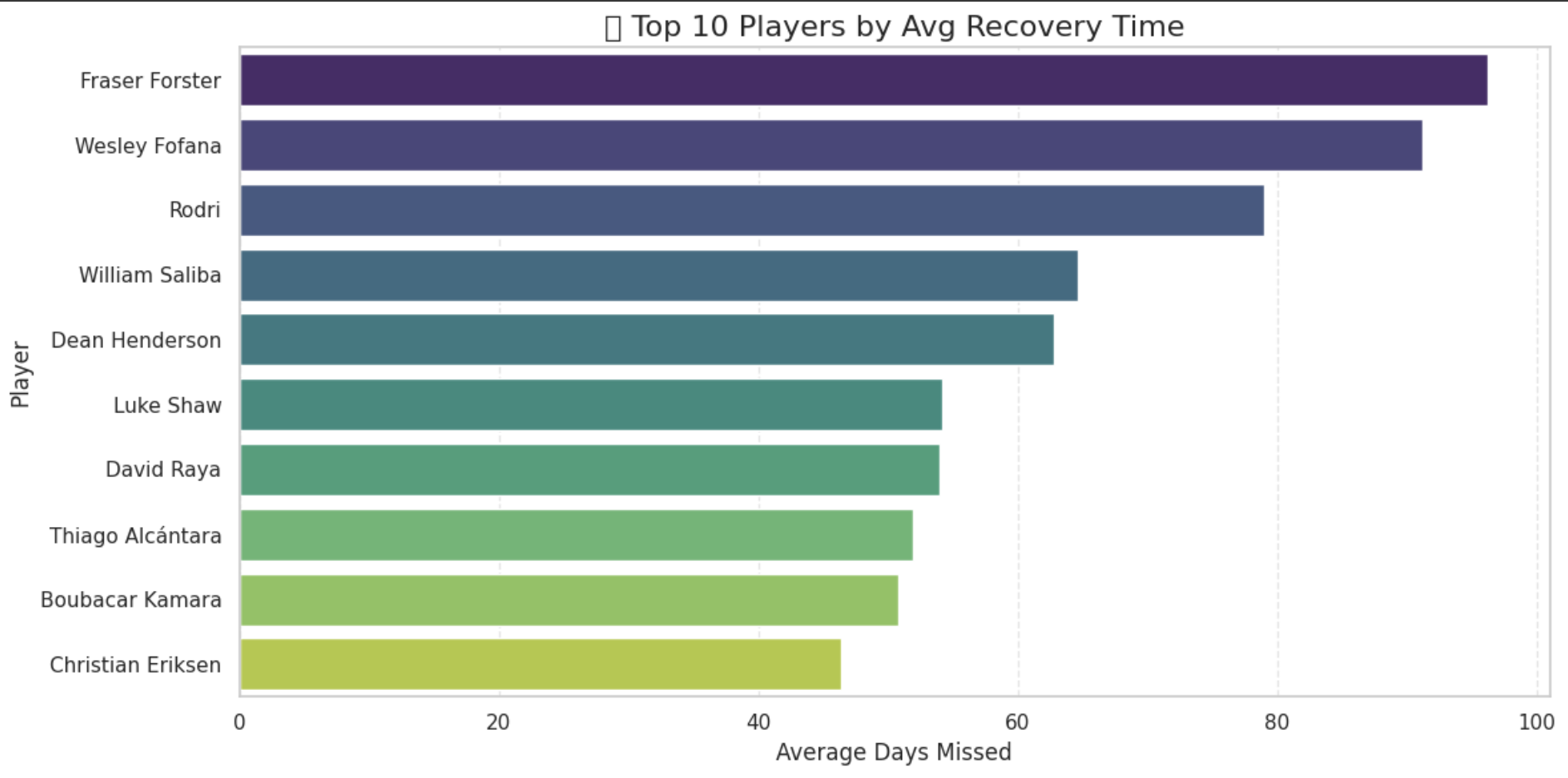

⏳ Top 10 Players by Average Recovery Time

Fraser Forster and Wesley Fofana topped the list of players with the highest average recovery durations, both missing close to 100 days per injury. These extended periods on the sideline not only affect team dynamics but also signal deeper injury management challenges.

Other key players such as Rodri, William Saliba, and Thiago Alcântara also spent significant time out, often due to recurring muscle or ligament issues. The chart highlights the need for individualized recovery planning and medical interventions for high-value assets.

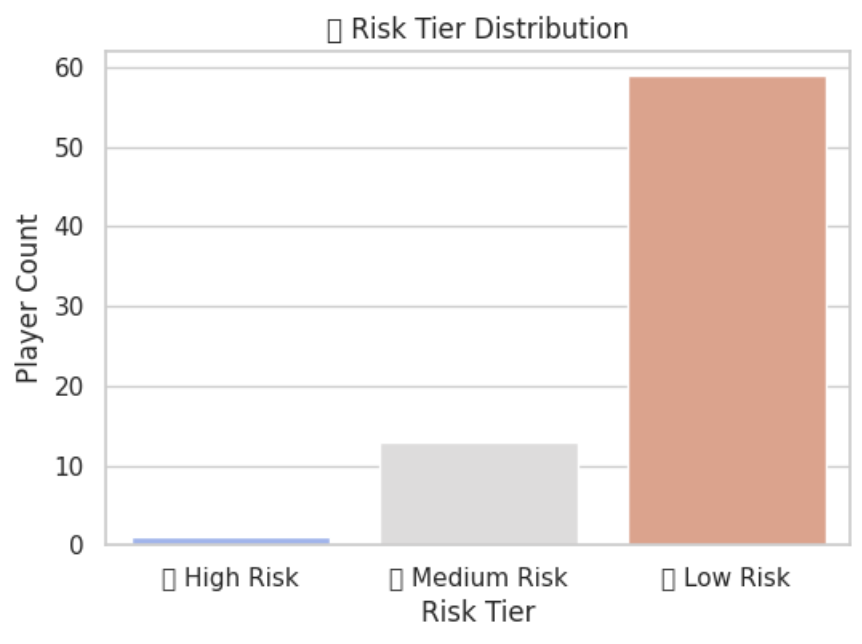

📊 Risk Tier Distribution

Most EPL players fall under the Low Risk injury tier, with only a handful in the High Risk category. This segmentation helps clubs plan rotations, medical support, and player investment decisions.

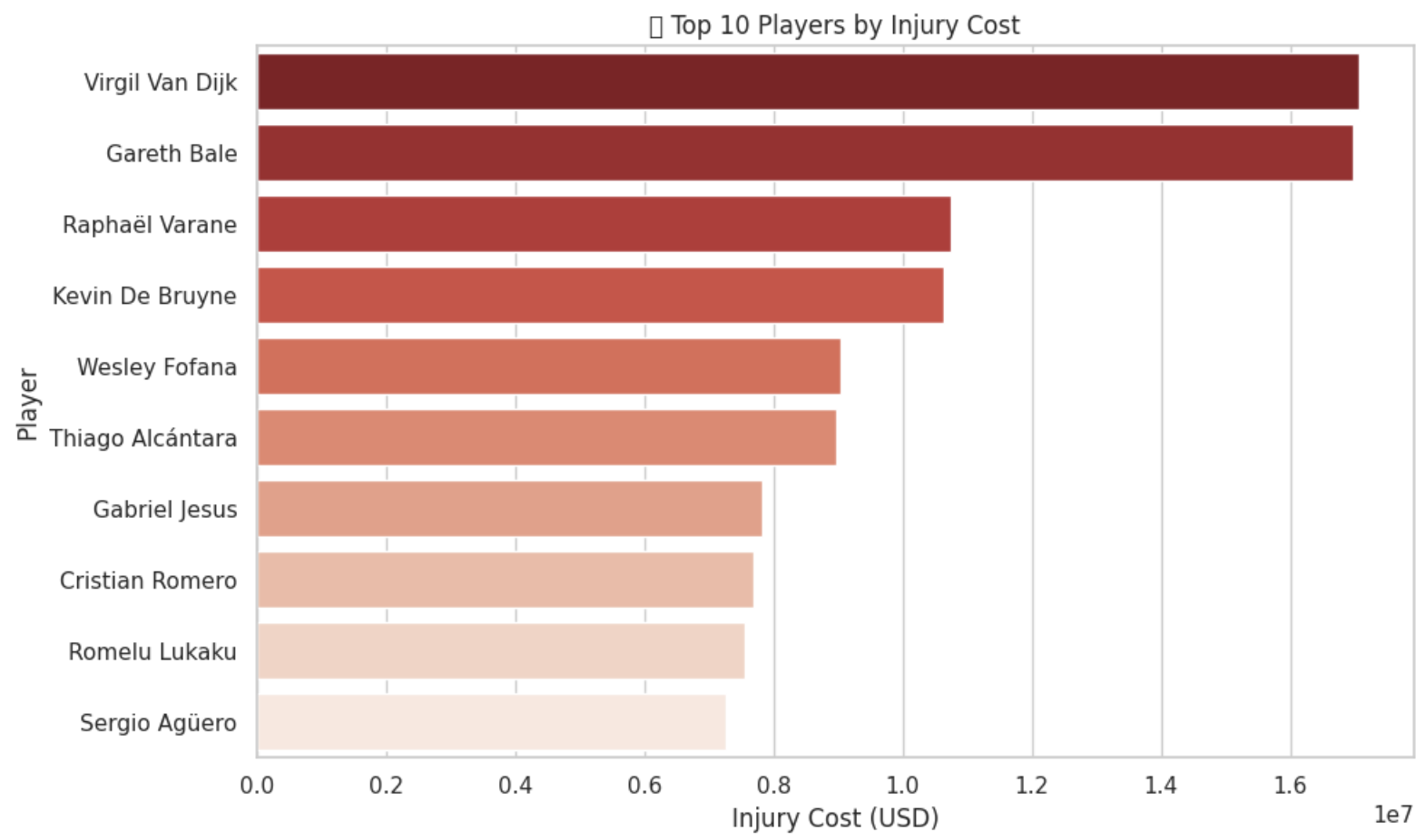

💸 Top 10 Players by Injury Cost

Players like Virgil Van Dijk, Gareth Bale, and Raphaël Varane topped the list of costliest injury cases. These absences not only disrupted tactics but also incurred multi-million dollar financial losses.

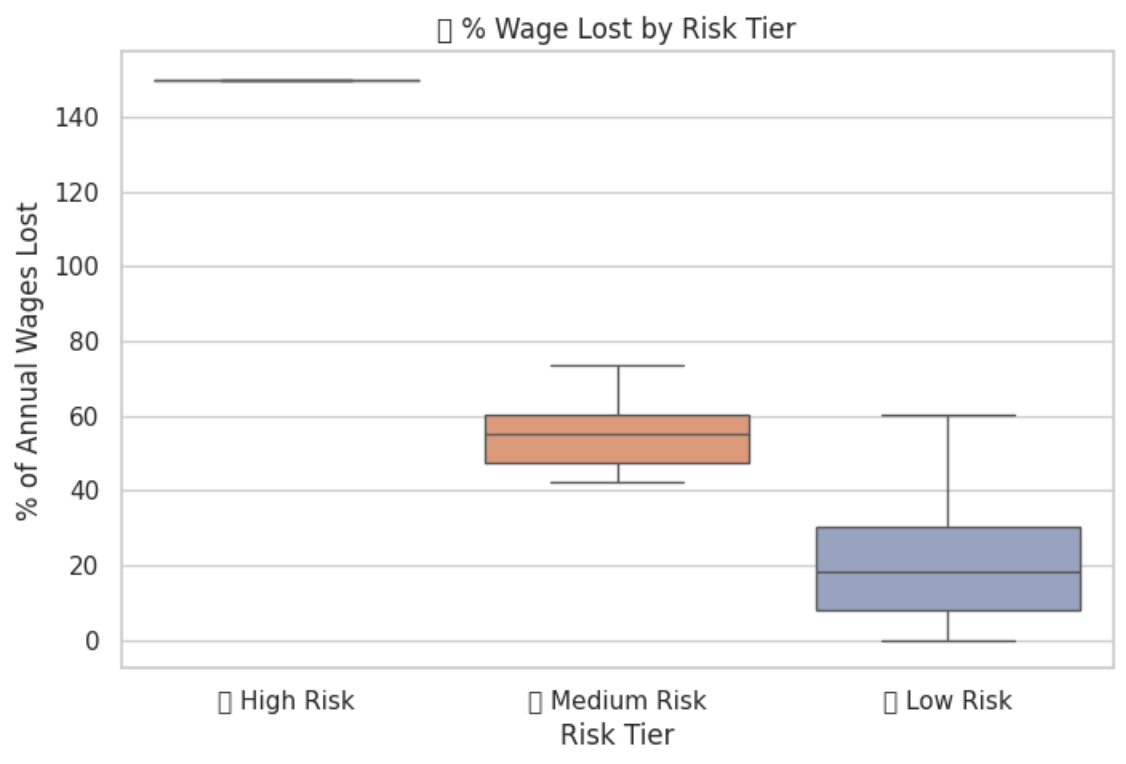

📉 % Wage Lost by Risk Tier

High Risk players had a median wage loss exceeding 100% of annual salary due to repeated injuries, underscoring their volatility. In contrast, Low Risk players showed far better financial reliability.

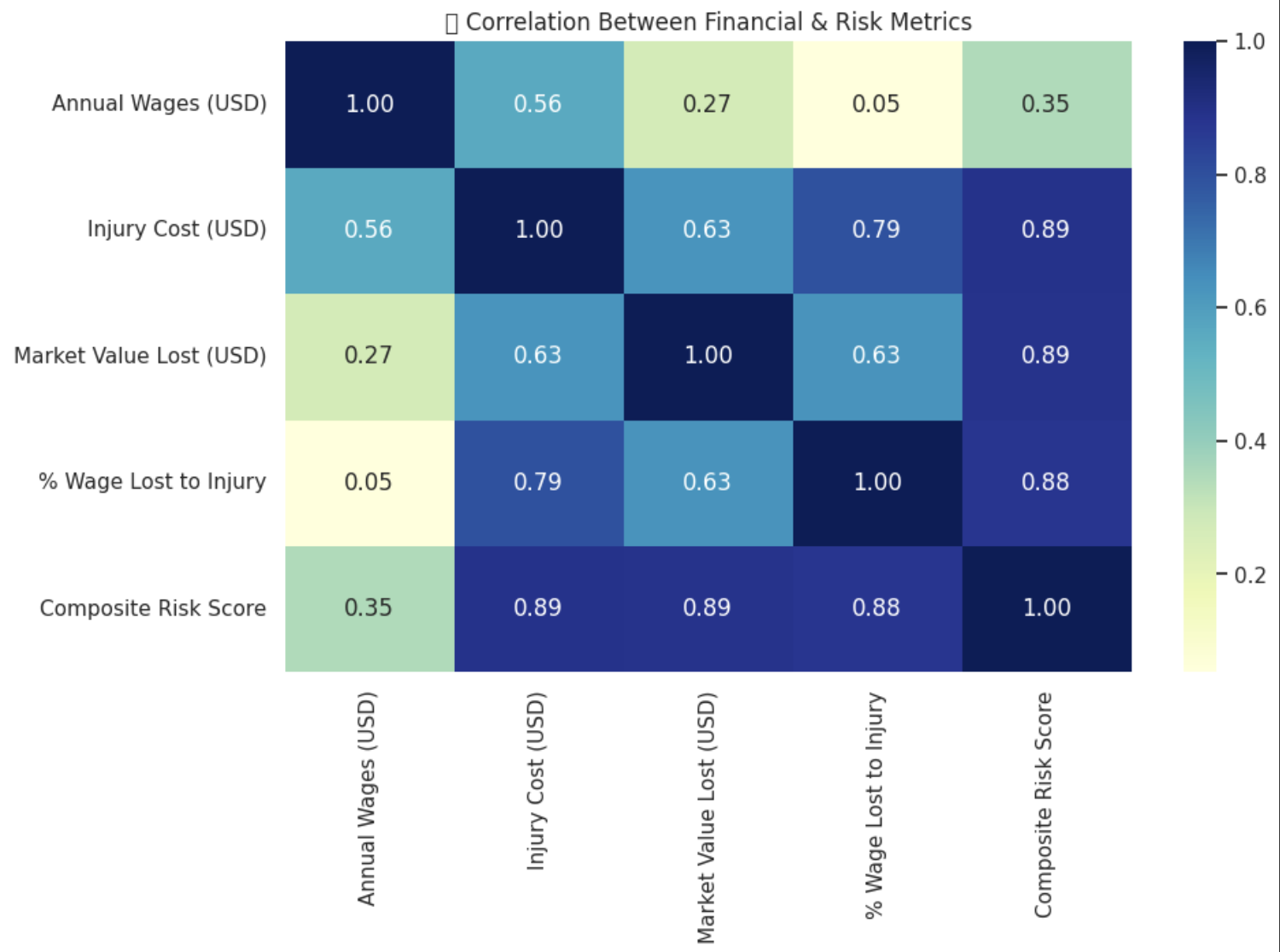

🧠 Correlation Between Risk & Financial Metrics

Composite Risk Score showed high correlation with injury cost, market value loss, and wage loss — proving that player fragility is a key driver of financial instability.

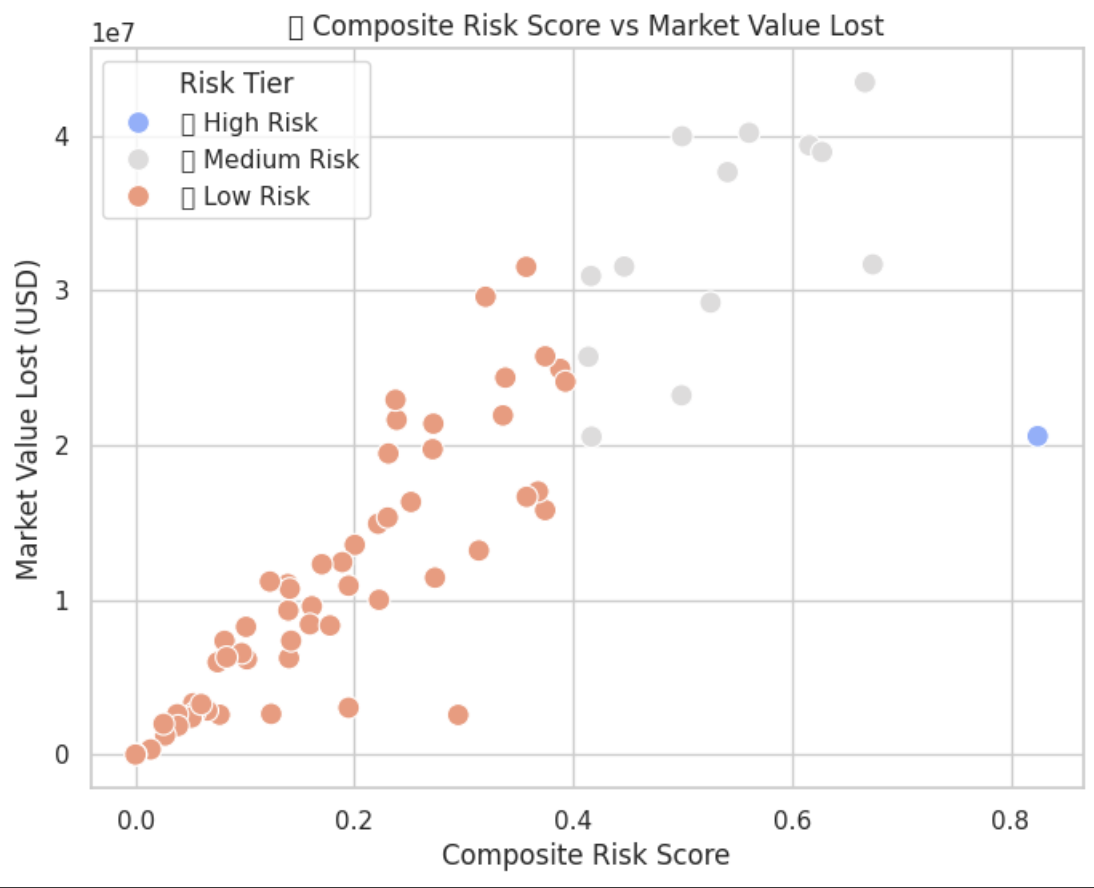

📉 Composite Risk vs Value Lost

A clear trend emerges — higher risk players lead to greater market value depreciation. These insights support smarter contract decisions and better depth planning.